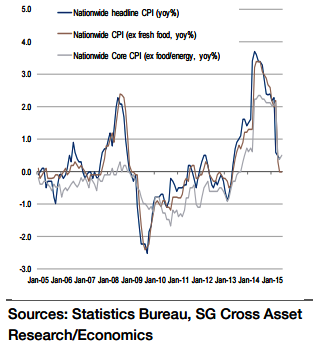

There will be a base effect due to last year's rise in oil prices that continued through to mid-2014. Although the BoJ is aiming at achieving a 2% price stability target, Japan CPI (excluding fresh food) likely fell below 0% yoy, its weakest point since April 2013.

"Japan's nationwide CPI (excluding fresh food) likely fell to -0.2% yoy in July (was +0.1% yoy in June). Factors such as the passing on of price increases to products as a result of costpush inflation caused by yen depreciation and the recovery in domestic demand are helping to push up inflation", says Societe Generale.

Since April, the effects of upward pressure on wages have been getting stronger due to the improved balance of labour supply and demand. In Q4, the base effect due to the fall in oil prices will also fade out. As a result, prices will pick up on a yoy basis. However, oil prices have fallen again since July.

Moreover, the main cause of the negative Q2 GDP growth was weak consumption. It would seem that consumers have not yet recovered completely from the deterioration of consumer sentiment after the consumption tax (CT) hike in April 2014, especially as food prices are continuously increasing. As a result, consumers have been defensive.

More stagnant inflation for Japan in July

Wednesday, August 26, 2015 4:35 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion

Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion  Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears

Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears  China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI

China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI  U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector

U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector  European Stocks Slide as Middle East War Fears and Rising Oil Prices Shake Markets

European Stocks Slide as Middle East War Fears and Rising Oil Prices Shake Markets  Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar

Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar  Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise

Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise  China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security

China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security  Gold Prices Rebound in Asia as U.S.–Iran Tensions Support Safe-Haven Demand

Gold Prices Rebound in Asia as U.S.–Iran Tensions Support Safe-Haven Demand