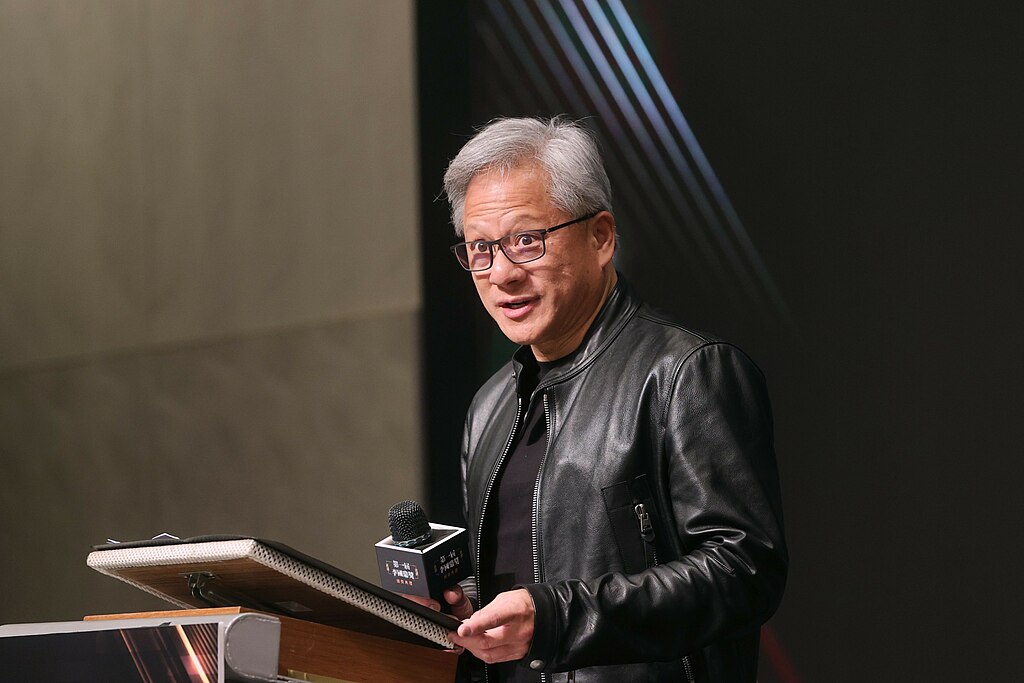

Nvidia CEO Jensen Huang is reportedly planning a trip to China in late January as the company seeks to revive access to one of its most important markets for artificial intelligence chips. According to a Bloomberg News report citing a source familiar with the matter, Huang is expected to attend Nvidia-hosted events ahead of the Lunar New Year holiday period in February and may also travel to Beijing during the visit.

The report noted that while the trip is being planned, it remains unclear whether Huang will meet with senior Chinese government officials. Any potential meetings are still subject to confirmation, and his travel plans could change depending on diplomatic and regulatory developments. Nvidia has declined to comment on the report, and Reuters said it was unable to independently verify the details.

The potential visit comes at a sensitive time for Nvidia, which has been navigating tightening U.S. export controls and growing geopolitical tensions surrounding advanced semiconductor technology. Just last week, the Trump administration formally approved the sale of Nvidia’s H200 artificial intelligence chips to China. The H200 is the company’s second-most powerful AI chip and the approval was widely seen as a step toward resuming shipments to Chinese customers, despite opposition from China hawks in Washington who have raised national security concerns.

However, optimism was short-lived. On January 14, Chinese customs authorities stated that the H200 chips were not permitted to enter the country, according to a Reuters report. This contradiction has added to uncertainty around Nvidia’s ability to do business in China and highlights the complex regulatory environment facing global semiconductor companies.

China has historically been a crucial market for Nvidia, particularly as demand for AI chips continues to surge worldwide. Huang’s reported visit underscores the strategic importance of China to Nvidia’s long-term growth and the company’s efforts to maintain relationships and explore pathways to compliance amid evolving trade restrictions.

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock