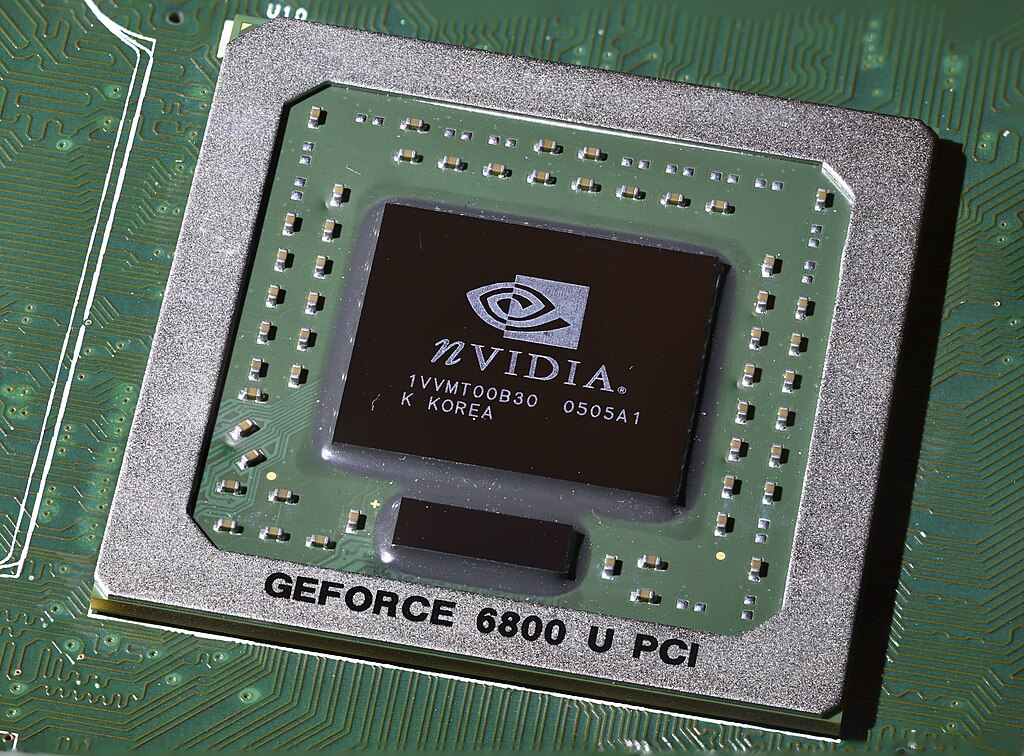

Reports earlier this week suggested that Nvidia (NASDAQ: NVDA) had agreed to acquire AI chip startup Groq in a $20 billion all-cash transaction. However, updated details clarify that the arrangement is not a traditional acquisition but a strategic, non-exclusive inference technology licensing agreement aimed at accelerating artificial intelligence inference at global scale.

Groq, a designer of high-performance AI accelerator chips founded by former Google TPU engineers, confirmed that Nvidia will license its inference technology rather than purchase the company outright. The agreement focuses on expanding access to fast, predictable, and cost-efficient AI inference, an area gaining importance as AI workloads shift from training to deployment. Groq will continue to operate as an independent company, with Simon Edwards appointed as chief executive officer.

As part of the deal, Groq founder Jonathan Ross, President Sunny Madra, and other key team members will join Nvidia to help scale and advance the licensed technology. Importantly, the agreement does not grant Nvidia exclusive rights to Groq’s technology, nor does it involve the acquisition of Groq’s intellectual property. Nvidia has not yet officially commented on the partnership, while its shares rose modestly in premarket trading following the news.

Groq recently raised $750 million at a valuation of approximately $6.9 billion, making the reported $20 billion figure notable even for a licensing arrangement. Wall Street analysts have weighed in on the strategic implications. Bank of America analyst Vivek Arya said the deal reflects Nvidia’s recognition that while GPUs dominate AI training, inference workloads may increasingly benefit from specialized chips. Groq’s Language Processing Units, or LPUs, are designed for highly predictable and ultra-fast inference using large amounts of on-chip SRAM, contrasting with Nvidia’s general-purpose GPUs that rely on high-bandwidth memory for scalability.

Analysts suggest future Nvidia systems could integrate GPUs and LPUs within the same rack, potentially connected by NVLink. Others noted that while the price appears high for a non-exclusive license, it is relatively small compared with Nvidia’s massive cash position, free cash flow, and multi-trillion-dollar market capitalization. Overall, the deal is viewed as a strategic move to strengthen Nvidia’s position in the rapidly evolving AI inference market.

Pokemon Pokopia Sells 2.2 Million Copies in Four Days, Boosting Nintendo Switch 2 Momentum

Pokemon Pokopia Sells 2.2 Million Copies in Four Days, Boosting Nintendo Switch 2 Momentum  Broadcom Stock Jumps After Strong Earnings Beat and Bullish AI Revenue Outlook

Broadcom Stock Jumps After Strong Earnings Beat and Bullish AI Revenue Outlook  Nintendo Stock Surges 10% as Pokémon Pokopia Breaks Sales Records

Nintendo Stock Surges 10% as Pokémon Pokopia Breaks Sales Records  Nissan, Uber, and Wayve Team Up to Launch Robotaxi Pilot in Tokyo

Nissan, Uber, and Wayve Team Up to Launch Robotaxi Pilot in Tokyo  Trump Administration Proposes Tough AI Contract Rules as Anthropic Blacklisted by Pentagon

Trump Administration Proposes Tough AI Contract Rules as Anthropic Blacklisted by Pentagon  Big Tech Turns to Debt Markets to Fund AI Infrastructure Boom

Big Tech Turns to Debt Markets to Fund AI Infrastructure Boom  UK Regulators Demand Social Media Platforms Strengthen Children's Age Verification

UK Regulators Demand Social Media Platforms Strengthen Children's Age Verification  BMW Warns of Further Earnings Decline in 2026 Amid Global Trade Pressures

BMW Warns of Further Earnings Decline in 2026 Amid Global Trade Pressures  Nvidia CEO Jensen Huang Says $100B OpenAI Investment Unlikely as AI Demand Surges

Nvidia CEO Jensen Huang Says $100B OpenAI Investment Unlikely as AI Demand Surges  Costco Faces Class Action Lawsuit Over Tariff Refunds as Supreme Court Strikes Down Trump's IEEPA Tariffs

Costco Faces Class Action Lawsuit Over Tariff Refunds as Supreme Court Strikes Down Trump's IEEPA Tariffs  Amazon Engineers Investigate AI-Linked Outages as GenAI Coding Tools Raise Reliability Concerns

Amazon Engineers Investigate AI-Linked Outages as GenAI Coding Tools Raise Reliability Concerns  Heinz Wattie's to Close Three New Zealand Plants, Cutting 350 Jobs

Heinz Wattie's to Close Three New Zealand Plants, Cutting 350 Jobs  Yann LeCun's AI Startup AMI Raises $1 Billion at $3.5 Billion Valuation

Yann LeCun's AI Startup AMI Raises $1 Billion at $3.5 Billion Valuation  California Court Rejects xAI Bid to Block AI Data Transparency Law

California Court Rejects xAI Bid to Block AI Data Transparency Law  Oracle Stock Surges as AI Data Center Boom Drives Revenue Beat and Bullish 2027 Outlook

Oracle Stock Surges as AI Data Center Boom Drives Revenue Beat and Bullish 2027 Outlook  Amazon Invests $535 Million in Brisbane Robotics Fulfillment Center

Amazon Invests $535 Million in Brisbane Robotics Fulfillment Center  Amazon Website Outage Disrupts Thousands of U.S. Shoppers Before Services Recover

Amazon Website Outage Disrupts Thousands of U.S. Shoppers Before Services Recover