Last year in November, OPEC and participating non-OPEC countries agreed to extend the production cut agreement that has reduced global oil supplies from those countries by 1.76 million barrels per day compared to the October 2016 level. The deal is widely being credited with bringing global inventories closer to their five-year average from a record high. The deal coupled with ongoing geopolitical tensions in countries in the Middle East has been successful in pushing the crude oil prices to their highest levels in three years. The North American benchmark WTI is currently trading at $63.5 per barrel and Brent $5.9 per barrel premium to WTI.

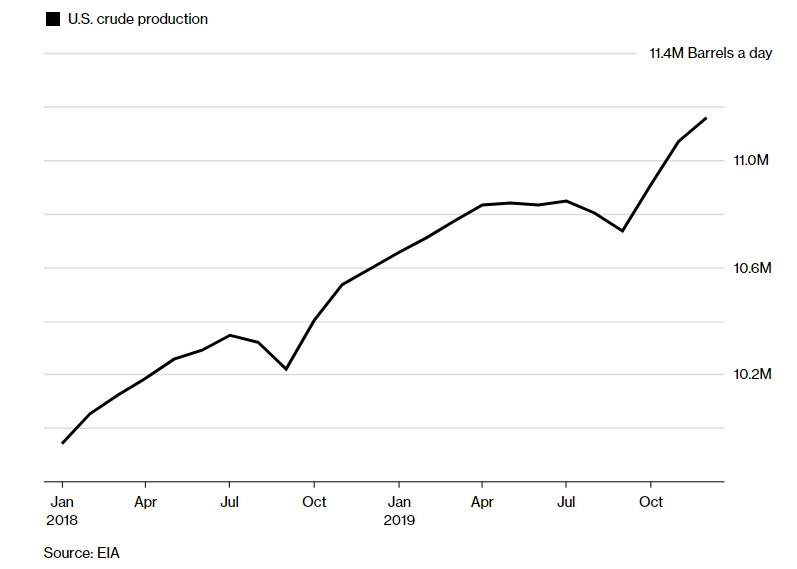

However, the latest supply forecasts by Energy Information Administration (EIA) suggests that such euphoria in the oil market could be a short-lived one. According to EIA, U.S. oil production would increase to 10 million barrels per day as early as next month, and by the end of the year, it would reach 10.6 million barrels per day. EIA projects an even sharper increase in 2019 with production reaching 11.4 million barrels per day the end of that year.

Such an increase would significantly reduce the impact OPEC deal is having on the oil prices.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022