While the oil market continues to focus on supply/demand fundamentals, these are some key updates that you need to keep a tab on,

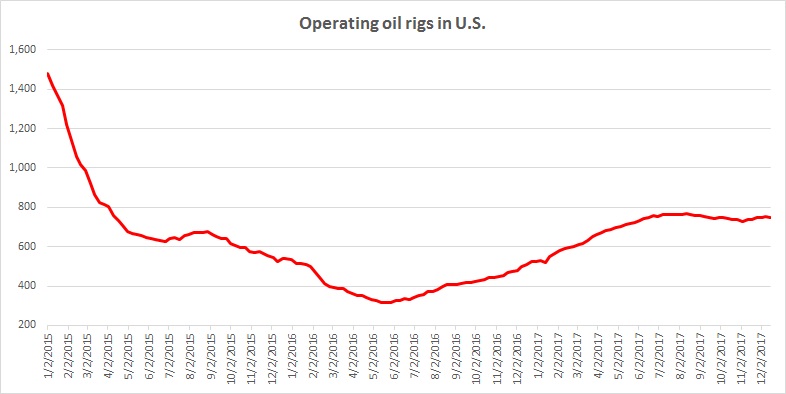

- U.S. oil rig count: The United States has already proved to be a major influencing factor in the global oil market as production reached a record high of 9.78 million barrels per day. To keep a tab on U.S. oil supplies, one needs to keep oneself updated on the numbers of oil rigs operating in the United States. As of latest report, the numbers of operating rigs have declined to 747. The numbers of operating rigs have increased more than 140 percent since bottoming in May last year.

- Venezuela: Venezuela’s cash-strapped state oil firm PDVSA said that it had initiated bank transfers on Thursday to pay US$539 million in interest on four separate bonds, just hours before grace periods on those payments expire between Friday and Sunday.

- Canadian oil: Concerns are on the rise for Canadian oil producers as Canada’s benchmark heavy crude, West Canada Select (WCS) is trading at a heavy discount to other oil benchmarks. You can check out the price below.

Key global oil benchmarks:

WTI - $57.6/barrel

Brent - $63.4/barrel

OPEC basket - $61.5/barrel

Urals - $63.3/barrel

Oman - $62.1/barrel

Dubai - $61.1/barrel

Western Canada Select - $33/barrel

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022