Two key developments are expected to shape Australia's monthly credit data for July. One is the beginning of a moderation in credit growth to housing investors as a result of regulatory pressure.

Banks have raised mortgage rates to such investors, and will also be more restrictive in their lending policy given warnings by the regulator (APRA) that banks which exceed the 10% guidance on maximum growth in this segment will be subject to special attention and potentially be forced to make additional provisions.

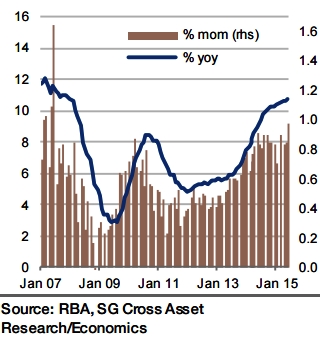

"This may begin to affect the data in July or in any case soon, after a particularly strong expansion in June (12.3% mom annualised). Two, some revival is expected in credit growth to businesses which has been weak for the last four months", says Societe Generale.

In light of recent legislation encouraging small investment activity through tax breaks, a pick-up in credit demand ought to materialise, and in any case rather optimistic about non-resource investment activity.

"As to the mainstay of credit growth, lending to owner-occupiers for house purchasing, steady growth of 5 -6% is expected in annualised terms. In short, easy monetary policy is expected to remain effective in supporting credit growth", added Societe Generale.

Regulatory pressure beginning to slow Australian housing investor credit

Monday, August 31, 2015 5:17 AM UTC

Editor's Picks

- Market Data

Most Popular

EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy

EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy  Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks

Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks  Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility

Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility  Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply  KOSPI Surges Over 12% as South Korean Stocks Rebound on Chipmaker Rally

KOSPI Surges Over 12% as South Korean Stocks Rebound on Chipmaker Rally  U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns

U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns  Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion

Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion  Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears

Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears  China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI

China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI  Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume

Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume