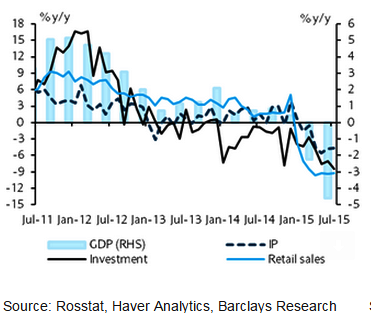

Russia growth indicators for July deteriorated further. In particular, real wages declined 9.2% y/y from an unrevised -7.2% and revised -8.6% in June and investment fell 8.5% y/y from -7.1% in June. Retail sales, industrial production and unemployment improved slightly and were moderately better than forecasts.

Moderate improvement had ben expected in all these variables, signaling a bottoming out of the recession. Instead the data point to further worsening of the recession in Q3.

"However, the rate of decline will likely moderate from the steep rate in Q2 when real GDP fell 2.5% q/q, nearly double the Q1 rate of decline. Growth is forecasted to record -4.0% in 2015 and be slightly negative in 2016 (because of base effects). However, there are downside risks to forecasts if the economy continues to deteriorate into Q4", says Barclays.

The drop in global oil prices is a factor extending the duration of to Russia's recession. In our view, imports, consumption and investment had already largely adjusted to previous declines in oil prices and the impact of sanctions.

Russia's economic growth indicators signal extended recession

Thursday, August 20, 2015 3:43 AM UTC

Editor's Picks

- Market Data

Most Popular

Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock

Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock  Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure

Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure  Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement

Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement  MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains

MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains  Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook

Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks Rally as Nvidia Earnings Loom, Oil Prices Near Seven-Month Highs

U.S. Stocks Rally as Nvidia Earnings Loom, Oil Prices Near Seven-Month Highs