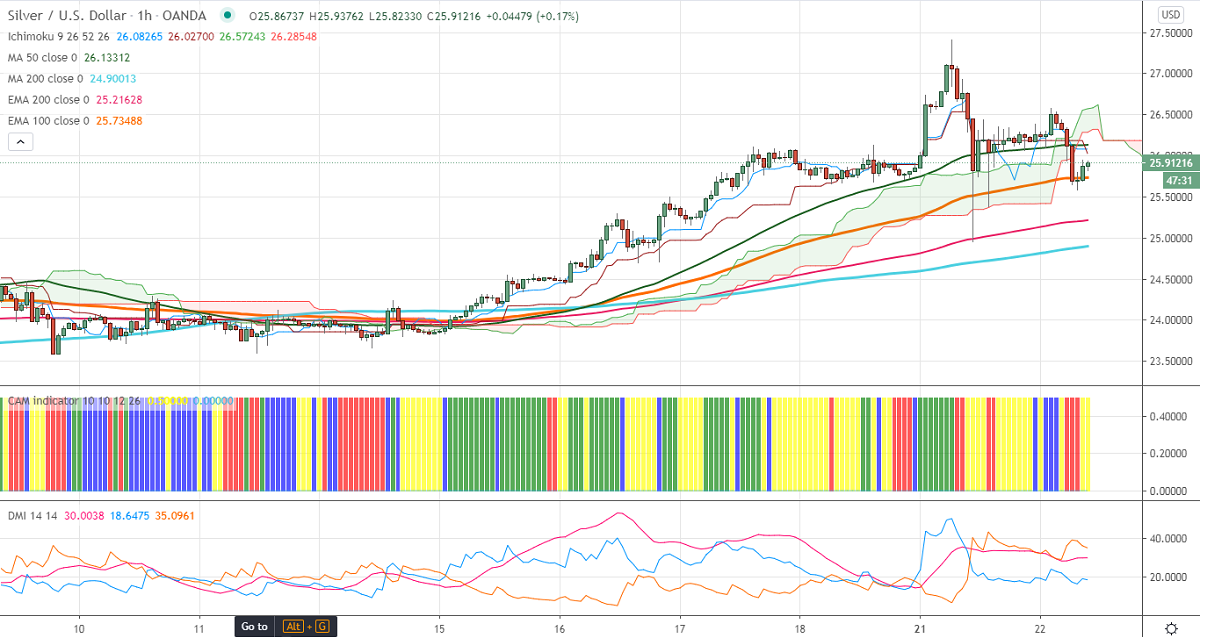

Ichimoku Analysis (Hourly chart)

Tenken-Sen- $26.08

Kijun-Sen- $26.18

Silver is consolidating between $24.96 and $26.58 for the past two days. The commodity trend is on the higher side on COVID-19 spread across UK. European countries have started to ban flights coming from the UK on the new coronavirus. The spread of the new virus has increased the demand for the precious metal. The increase in demand for silver in industrial uses, especially in the 5G global platform.

The gold/silver ratio has declined from 85 till 69, slightly above 5- year low of 65. It shows that silver is cheap compared to gold.

Technically, commodity took support near 200- H EMA and any significant weakness only below $24.95. A dip till $24.48/$23.89 possible. On the higher side, near term resistance is around $26.69 (61.8% fib) and indicative break above targets $27/$27.92.

It is good to buy on dips around $25.45-50 with SL around $24.96 for TP of $27.45.