The Spanish service sector continued to see solid growth of business activity during October, on spike in new orders and promotions, in spite of a slowdown in new order growth. The rate of job creation also eased over the month, but business confidence strengthened.

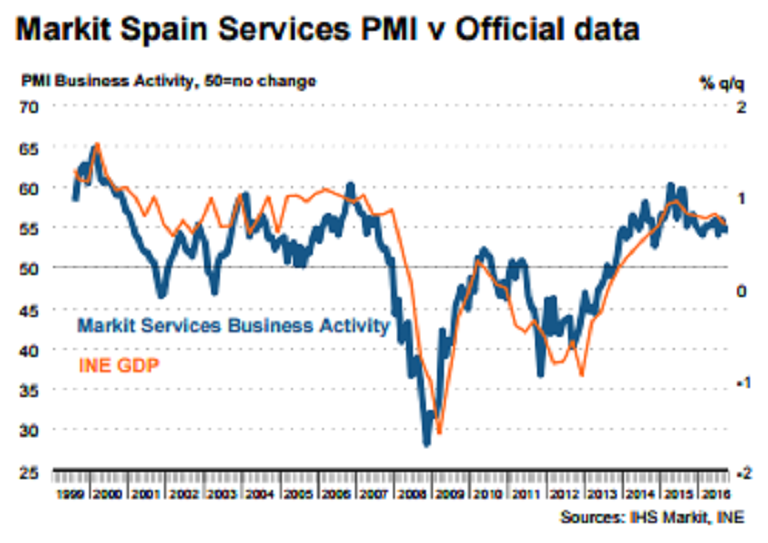

The headline seasonally adjusted Business Activity Index posted 54.6 in October, down fractionally from the reading of 54.7 in September but still signalling a solid monthly expansion of business activity. On the price front, the rate of cost inflation quickened to a 17-month high, but companies left their output prices unchanged.

New orders at Spanish service providers increased for the thirty-ninth consecutive month in October. Some panellists reported having secured new customers, while others mentioned the positive impact on new business of promotional activity. However, the rate of expansion eased to the slowest since November 2014.

Rising costs for fuel, energy and staff all contributed to an increase in input prices during October. Moreover, the rate of inflation quickened to a 17- month high. Hotels & Restaurants and Transport & Storage posted the fastest increases in input costs.

Meanwhile, expectations of new order growth and hopes of reduced political uncertainty were behind positive sentiment, with optimism signalled at around 47 percent of panellists.

"IHS Markit forecasts Spanish GDP to rise 3.1 percent in 2016, easing to 2.0 percent in 2017," said Andrew Harker, Senior Economist, IHS Markit.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility