Well, the much awaited Fed's stance was finally as dovish as they could be, there are certain concerns about a tail risk scenario developing in Asia. The scenarios are going along with the following channels, when the Fed hikes, US interest rates rise, the USD rises, Asian debt is sold off, Asian corporates are forced into buying USDs to redeem debt, resulting the USD higher, and in turn tightening monetary conditions further, and so on.

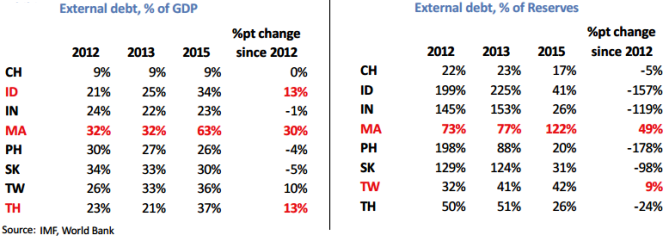

MYR the most worrying among Asian currency crosses, bear monitoring metrics such as short-term external debt to GDP and short-term external debt to FX reserves are key indicators of an economy's resilience to external shocks. Malaysia stands out as having the weakest metrics as you can observe from the above diagram briefing evolution of these debt metrics since 2012.

IDR and THB have both seen a noticeable rise in external debt as a percentage of GDP, but the overall ratios remain relatively low at 34% and 37%, respectively. Likewise, Taiwan's reserve cover has deteriorated since 2012, although overall coverage has yet to reach concerning levels. Not only has external debt almost doubled as a proportion of GDP, but reserve cover has also deteriorated sharply.

With a Fed hike around the corner is likely to prolong for another 2-3 months, the spotlight shifts back to the spillover effects on Asian economies. This time, however, we expect a Fed rate hike to have a very different impact on the relative performance of Asian FX. MYR, IDR, TWD, and KRW are the most vulnerable to higher US rates and a higher USD. On the other end of the spectrum, RMB, INR, and PHP appear to be in the strongest positions.

Spillover effects of Fed’s rate decision on Asian FX baskets, MYR under stress

Friday, September 18, 2015 1:21 PM UTC

Editor's Picks

- Market Data

Most Popular

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000