The timing of a rise in interest rate has been a double-crossing theme. Yet bond sell-offs arise, badly hurting fixed income and global macro portfolios.

What relief can be found in systematic strategies? To what extent does the premium paid for insurance against interest rate rises erode a fixed income portfolio performance?

The option market maker who sells options and hedges position on a regular basis as the trend follower is in the same position.

When the asset deviates from the strike and when the delta of its position increases, the option hedger will buy more of the underlying asset.

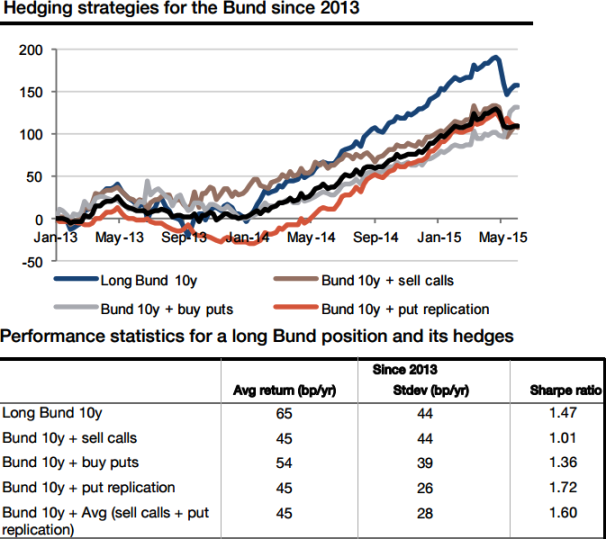

The graph demonstrates the total performance in bps equivalent (i.e. the gain in basis points) of an outright long position in 10y German Treasuries and the combination of this long position in 10y German Treasuries and one of the three systematic strategies given in the nutshell.

The black line indicates the performance for a long position in German Treasuries, combined with a put replication strategy and a programme selling receivers on 10y rates.

Here, in German bond market case, Gap risks such as the one witnessed in April/May will remain unhedged as the German bond yields have been performing well.

But the traders who are risk averse can still prefer any of the combined strategies according to the circumstances.

Trade laggards can deploy momentum strategies on German treasury bonds

Wednesday, June 10, 2015 6:53 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand