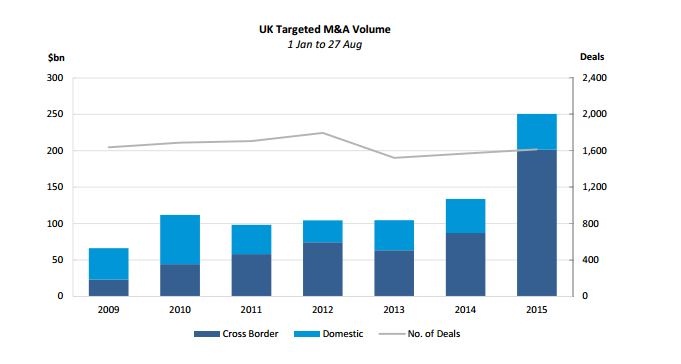

Businesses are showing more confidence since the financial crisis, when it comes mergers and acquisition. Volume of deals have hit the fastest pace since 2007, just before financial crisis soured mood.

- The value of M&A deals in the UK so far this year stands at roughly $251 billion, the largest since $291.2 billion generated in the first eight months of 2007, as per data provider Dealogic.

- Cross border deals have hit close to $200 billion, while rest is domestic.

- This year it is up significantly, given total deal value of around $350 billion for total for past three year combined. Chart courtesy Financial Times.

While at one hand, the data shows confidence among businesses to expand, it also provides a warning signs over market, as large number of deals generally takes place near market top.

UK's benchmark stock index, FTSE 100 has wiped out this year's entire gains and down just under -6% so far this year, trading at 6180.