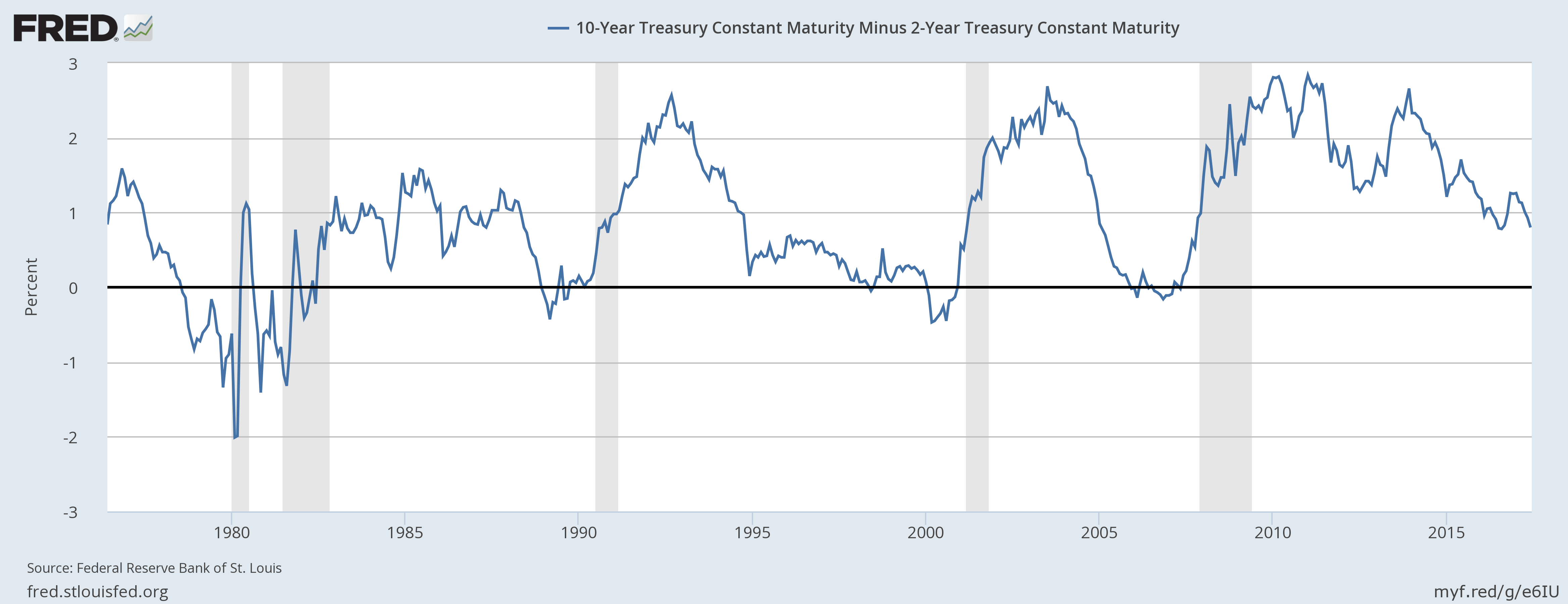

U.S. yield curve has continued its flattening, more so after the U.S. Federal Reserve decided to hike interest rates by 25 basis points earlier this week. The gap between the 10-year Treasury yield and 2-year Treasury, which is one of the measures of yield curve flattening/steepening has now declined to just 80 basis points. The spread has declined more than 50 basis points since its peak in last December. The spread has also declined to the lowest point since last September, which is indicating that the Trump-flation trade, which was triggered after the election outcome and was named after the winner Donald Trump, for the U.S. treasuries are over.

The decline has also raised concerns that a recession could be on the way. Historically speaking, the spread has proved to be a commendable forward indicator of a looming recession. Whenever this spread declines below zero, a recession follows. It correctly predicted the last five recessions since 1976. If the spread declines further, it would reach the weakest point in a decade.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed