Indonesia's GDP growth averaged just 4.7% in the first half of the year is likely to slowdown in second half of the year, as the economy is facing challenges from external sectors. In addition to the weaker CNY, slower economic momentum is likely to weigh on IDR spot for the rest of the year.

Indonesia faces strict monetary and fiscal policy constraints, despite the urgent need to arrest slowing growth and market pessimism. Bank Indonesia is unable to loosen its tight monetary policy stance, given high headline inflation of over 7%, well above its inflation target range of 3-5%, says Bank of America. Core inflation has been creeping higher as well.

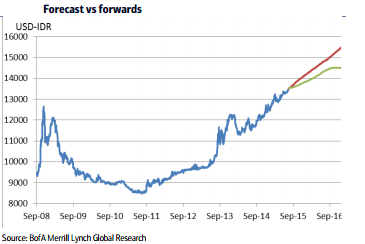

The IDR is expected to trade at 14000 per USD by 2015 and at 15000 by end of 2016, said Bank of America in a research note to its client. BI has said that it considers the current IDR levels as having overshot fundamentals. BI also said that it does not have a target level for the IDR but will intervene to stabilize the currency. BI's actions, such as reducing the volume and frequency of FX swap auctions, are expected to have a moderating effect on dollar demand and support the IDR.

USD/IDR likely to reach 15000 by end of 2016

Tuesday, September 1, 2015 7:25 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX