International developments moved to the back seat this week, as the risks stemming from Greek debt crisis and China’s equity market eased off for now. However, renewed weakness in commodity sector and concerns over corporate profitability weighed on market sentiment.

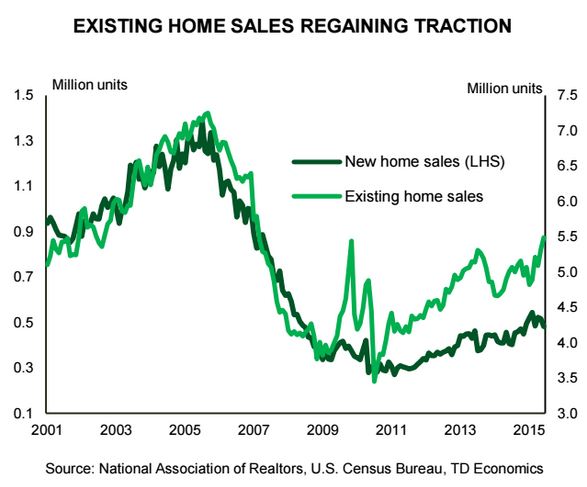

The domestic data flow remained relatively upbeat. Initial jobless claims fell to a multi-decade low. Existing home sales rose by 3.2% in June to a new cycle high. New home sales disappointed, declining by 6.8% in June, however they were still up 18% relative to a year ago.

Next week should bring further evidence of a rebounding economy, with second quarter GDP reading expected to show a 2.5% gain. The upturn in economic data is likely to be recognized in the Fed’s July interest rate announcement, which we expect to set the stage for September rate liftoff.

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply  U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector

U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume

Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume  Asian Stocks Slide as Middle East Conflict and Rising Oil Prices Shake Global Markets

Asian Stocks Slide as Middle East Conflict and Rising Oil Prices Shake Global Markets  KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking

KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking  Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar

Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar  China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength

China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength  European Stocks Slide as Middle East War Fears and Rising Oil Prices Shake Markets

European Stocks Slide as Middle East War Fears and Rising Oil Prices Shake Markets  Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty

Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX