Manufacturing sector accounts for around 23% of German GDP (well above the Eurozone average of around 16%) and among this, 15% is car production. Volkswagen is the biggest of Germany's car makers and one of the country's largest employers, with more than 270,000 jobs in its home country. With an annual production of more than 2.5 million cars the company accounts for 6% of the German manufacturing sector or 1.4% of German GDP.

The Volkswagen crisis has rocked Germany's business and political establishment and has the potential to become a bigger downside risk for the German economy than the Greek debt crisis. Analysts warn the crisis at the VW could develop into the biggest threat to Europe's largest economy. There is a serious risk that the fallout could spread to suppliers and other companies that depend on Volkswagen's health.

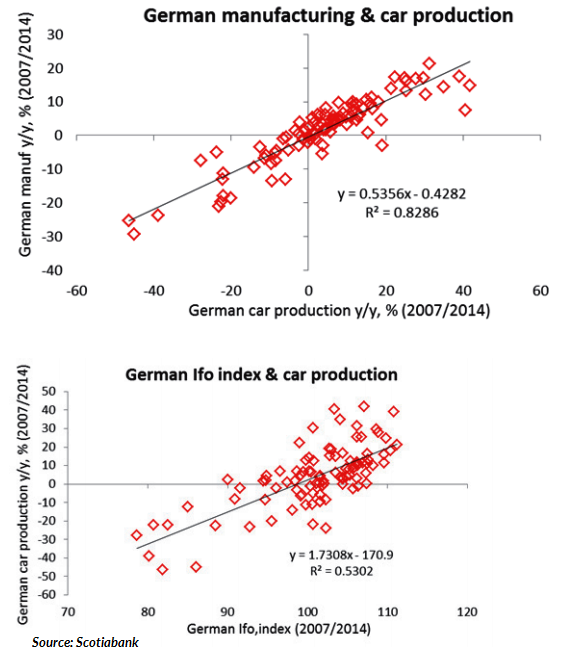

"In view of the share metrics above, we could say that the direct impact of a 10% drop in car production from Volkswagen would cut German GDP growth by around 0.15%. However, there would also likely be an additional indirect impact from the number of suppliers that also stand to suffer", notes Scotiabank in a research report.

Data suggest that 2015 is (or at least was) on track to be a strong year for the car industry. The most recent survey data coming out of both Germany and the rest of the Eurozone have continued to show a positive outlook for German growth and the car industry in general. More specifically, in September, the German Ifo surprised on the upside, moving up to 108.5, well above its long term average (around 102) and consistent with GDP growth of around 2.5% y/y.

However, these results were pre-date the Volkswagen (VW) crisis. As of now, there is a serious risk that the buoyancy of the German auto sector (and even manufacturing more generally) could suffer a big setback. Germany is already feeling the pinch of slowdown in the Chinese economy. Given the close relationship between German manufacturing and GDP, there is a possibility of a poor end to the year for growth.

Upcoming business surveys are likely to gauge the magnitude of the VW crisis on German GDP growth. The relationship between the German Ifo index and car production suggests that a 1- point fall in business sentiment would lead to a 1.5-2.0% fall in car production. That said, there is a risk that the survey data will over-react. A prime example of this is the ZEW survey, which tends to be very volatile, so the upcoming ZEW index should be interpreted with caution.

The euro fell 0.3 percent to 1.1237 against the greenback after gaining 0.7 percent on Tuesday. The single currency was pegged back by data that showed German industrial output fall in August at its fastest pace in a year, suggesting Europe's largest economy may have lost momentum in the third quarter.

Volkswagen Crisis Vis-à-vis German Growth

Wednesday, October 7, 2015 11:29 AM UTC

Editor's Picks

- Market Data

Most Popular

The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever  Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  U.S. Considers New Rules Tying AI Chip Exports to Investment and Security Guarantees

U.S. Considers New Rules Tying AI Chip Exports to Investment and Security Guarantees  Amazon Website Outage Disrupts Thousands of U.S. Shoppers Before Services Recover

Amazon Website Outage Disrupts Thousands of U.S. Shoppers Before Services Recover  Defense Contractors Move to Drop Anthropic AI After Trump Administration Ban

Defense Contractors Move to Drop Anthropic AI After Trump Administration Ban  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  Inspire Brands IPO Could Raise $2 Billion as Roark Capital Explores Public Listing

Inspire Brands IPO Could Raise $2 Billion as Roark Capital Explores Public Listing  Shell Signs Oil and Gas Agreements With Venezuela to Advance Dragon Gas Project

Shell Signs Oil and Gas Agreements With Venezuela to Advance Dragon Gas Project  U.S. Officials Review Tencent’s Stakes in Epic Games, Riot Games Over Security Concerns

U.S. Officials Review Tencent’s Stakes in Epic Games, Riot Games Over Security Concerns  Broadcom Stock Jumps After Strong Earnings Beat and Bullish AI Revenue Outlook

Broadcom Stock Jumps After Strong Earnings Beat and Bullish AI Revenue Outlook  Nvidia CEO Jensen Huang Says $100B OpenAI Investment Unlikely as AI Demand Surges

Nvidia CEO Jensen Huang Says $100B OpenAI Investment Unlikely as AI Demand Surges  Wizz Air Receives Tentative U.S. Approval for UK–U.S. Flights Amid Rising Travel Demand

Wizz Air Receives Tentative U.S. Approval for UK–U.S. Flights Amid Rising Travel Demand