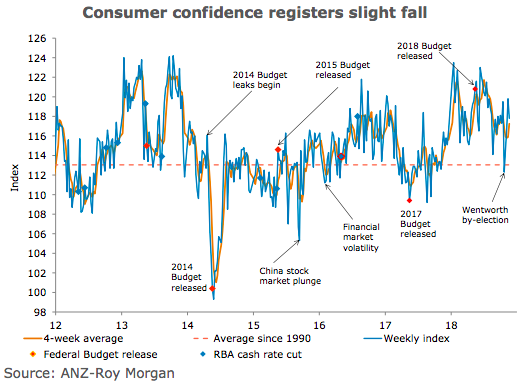

Australia’s ANZ-Roy Morgan weekly consumer confidence fell by 1.7 percent last week despite generally positive local economic data. Financial conditions sub-indices were negative, with current financial conditions and future financial conditions falling by 7.4 percent and 1.8 percent respectively.

The fall in the current financial conditions index unwinds the upturn since it plunged in the weekend of the Wentworth by-election. Economic conditions readings were mixed, with current economic conditions falling by 1.6 percent while future economic conditions rose by 1.3 percent.

Meanwhile, the 'time to buy a household item' sub-index was up marginally by 0.9 percent. Four-week moving average inflation fell again by 0.1 ppt to 4.3 percent.

"The consolidation leaves confidence well above its long-run average and a little above its level of a year ago. This is despite the fact house prices have been falling for more than a year on average for the country as a whole, albeit with considerable regional variation. With little domestic data this week, global news and petrol prices will dominate," said David Plank, ANZ’s Head of Australian Economics.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed