As expected by markets the RBA held interest rates at 1.5 percent at its October monetary policy meeting and refrained from adopting an explicit easing bias. Having eased monetary policy at its May and August meetings, the board judged that holding the stance of policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.

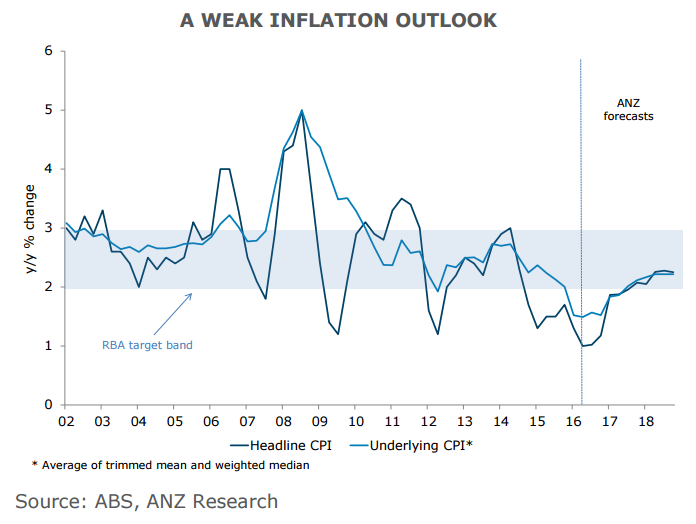

Inflation is a key consideration when it comes to the outlook for Reserve Bank of Australia's monetary policy. The Australian government publishes official CPI figures every quarter, and Q3 CPI data due for release on Oct 26 will be important in assessing any implications for monetary policy.

According to ANZ, the headline CPI is forecast to have risen by 0.5 percent q/q in Q3, slightly higher than the 0.4 percent q/q Q2 outcome, leaving annual inflation steady at 1 percent y/y. Trimmed mean is expected to have risen by 0.3 percent q/q and the weighted median by 0.4 percent q/q.

A private measure of Australian inflation expectations rose in October for the first time in three months, a sign that central bank policies were finally translating into faster price growth. The Melbourne Institute’s 12-month gauge of inflation expectations rose to 3.7 percent in October, from 3.3 percent the previous month. Last week, the Melbourne Institute said consumer inflation rose 0.4 percent in September and was up 1.3 percent on an annualized basis. That was the highest monthly reading since July.

In its recent communication, the RBA has sounded comfortable about policy settings. Australia's domestic economy looks more robust, commodity prices have risen and the property market has re-energised. The changes to the statement on the conduct of monetary policy have increased the RBA’s ability to tolerate below-target inflation on financial stability grounds.

"We expect Q3 CPI data to show that underlying inflation has remained weak. This would complicate the monetary policy outlook, although we don’t expect the RBA to mechanically respond to a low result," said ANZ in a report to clients.

AUD/USD bounces off from lows near the 0.75 handle and was trading around 0.7563 at around 11:45 GMT. The pair was back in the green, trading above 100-DMA support at 0.7532. Upside, for now, seems capped by 5-DMA at 0.7571. Technical indicators are bearish. Close below 100-DMA could see further drag.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary