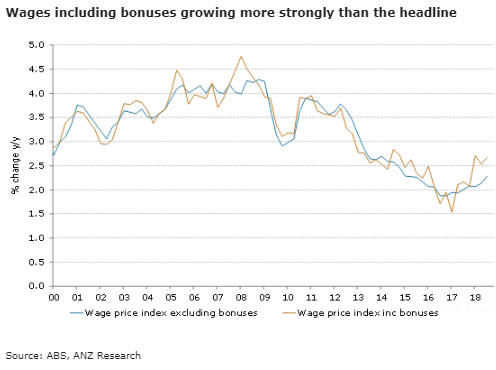

Australia’s wage price index for the third quarter of this year rose to its highest in three years, while the AUD/USD currency traded range-bound at the time of writing during Asian session Tuesday. Further inroads into unemployment and underemployment are necessary preconditions for a more meaningful uplift in wages, according to the latest report from ANZ Research.

The wage price index (WPI) rose by 0.6 percent q/q and 2.3 percent y/y in Q3, in line with market expectations but a bit softer than we expected, given the recent increase to the minimum wage. Public and private sector wage growth both rounded to 0.6 percent q/q, but in annual terms public sector wages pulled ahead to 2.5 percent y/y versus 2.1 percent y/y for the private sector.

Across industries, miners continue to experience the (equal) weakest wage growth at 1.8 percent y/y, although this accelerated from the previous quarter (1.3 percent y/y). Retail wages were also only up 1.8 percent y/y, though this was also an acceleration (from 1.5 percent y/y).

Wage growth accelerated in most sectors, with construction the only one to show a (modest) slowdown. Wages are growing fastest in health (2.8 percent y/y), education (2.7 percent y/y) and utilities (2.7 percent y/y) and are slowest in mining and retail (1.8 percent y/y), rental & real estate (1.9 percent y/y) and construction (1.9 percent y/y).

Across the states, wages in Western Australia (+1.6 percent y/y) and the Northern Territory (+1.7 percent y/y) remain the weakest, though they are picking up. Tasmanian workers are still enjoying stronger wage rises than their mainland counterparts (+2.6 percent y/y), with especially solid growth in private sector wages (+2.8 percent y/y).

Meanwhile, public sector employees in Victoria continue to enjoy the strongest wage gains (+3.3 percent y/y). At the time of writing, AUD/USD traded 0.03 percent lower at 0.7216.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record