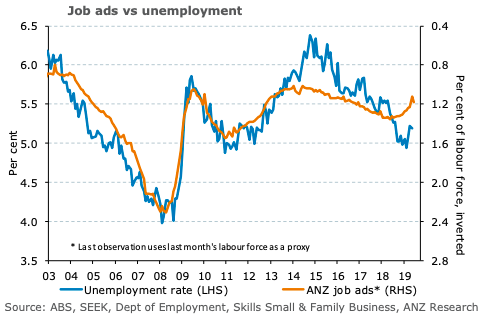

Australia’s employment growth is expected to stall in June. Most of the leading indicators suggest a sharp slowing in employment growth is due, according to the latest report from ANZ Research.

In addition, an unwind of election related employment is likely to impact the June report. Looking beyond the June report, the ANZ Labour Market Indicator points to the unemployment rate holding around 5.2-5.3 percent in the second half the year.

The Reserve Bank of Australia (RBA) can make progress toward an unemployment rate of 4.5 percent or lower without giving the economy additional stimulus.

"We think the RBA’s forecast update in August will recognise that at least one further rate cut is needed. But the RBA may decide to delay delivering that rate cut for a month or two," the report added.

Some reports suggested the consumer and business confidence data this week was disappointingly soft. We are inclined to be cautious in interpreting the numbers this way.

"All up we don’t think this week’s data provided the ‘smoking gun’ the RBA seems to need to ease as soon as next month. A weak employment report and soft CPI data may provide the impetus," ANZ Research further noted.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX