UK trade balance data to be published at 9:30 GMT today.

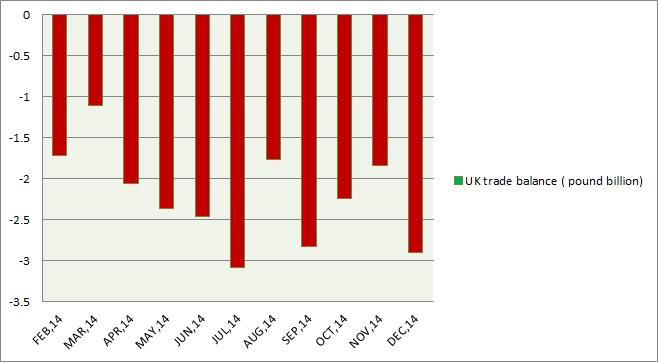

- UK trade balance so far continued its dismal performance and today's data may not be any exception. In December trade balance was £ -2.9 billion.

- So far, Pound remained focused on changes in monetary policy expectation and strong US dollar headwinds so the data may turn out to be a non-event.

However, this set of data might exert its importance not only on Pound over longer horizon but might tweak monetary policy expectation in near term.

Why?

- Ultra loose monetary policy by European Central Bank, Switzerland and Japan has led to rise of pound against these countries' currencies in spite of its more than 15% fall against dollar since last year.

- Debates are heating up on this issue even in Bank of England (BOE) policy meets. Last night, MPC member Wealer commented that probabilities of further deflation or future inflation is broadly balanced keeping the policy move open for tilting in either side. Moreover, he warned against the strength of Pound against other pairs except dollar.

BOE dilemma -

- Interest rate hike at this point would further strengthen pound especially against other European and emerging counterparts that would be heavily disadvantageous for UK.

- Going for a rate cut or dovish policy measure would make the Central Bank lose credibility after it reiterated its hawkish position over and over.

Probabilities -

- BOE would move to wait and watch mode for further guidance from economic and inflationary activities. Pound in such a case would weaken against dollar but may not against others much.

- It might bark the Pound down or by pushing the rate hike further the horizon.

Pound is currently trading at 1.498, after it broke major support of 1.50 yesterday.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary