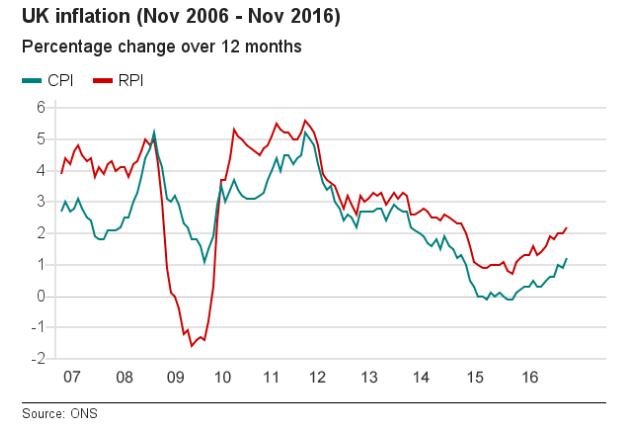

UK CPI inflation resumed the broad upward trajectory in November. Data released on Tuesday by the Office for National Statistics showed UK consumer prices rose 1.2 percent compared with a year ago, beating economists’ expectation for a 1.1 percent annual rise. The CPI ‘core’ rate (excluding energy, food, alcohol and tobacco) mostly drove the move, rising to 1.4 percent y/y from 1.2 percent in October.

November’s rise in headline inflation was relatively broadly-based. Details of the report showed expensive clothing and the impact of June’s Brexit vote on the prices paid by consumers for technology goods pushed UK's inflation to more than two-year high in November. British factory gate prices rose at an annual rate of 2.3 percent, while prices paid by factories for materials and energy fell more than 1 percent on the month but were up by nearly 13 percent compared with November 2015 - the biggest annual increase since October 2011.

Bank of England (BoE) forecasts that inflation would surge to about 2.8 percent by mid-2018, as sterling's slump after Brexit vote pushes up the cost of imports. November's data clearly underscores how inflation in Britain looks set for a sharp rise. BoE Governor Mark Carney has said the central bank could tolerate some overshoot against its inflation target, to help accommodate economic growth and employment.

"We continue to envisage an overshoot of the 2% target for CPI from 2017 Q2, reflecting both the upward push from weaker sterling as well as the firmer recent tone of energy prices. Further ahead, diminished capacity pressures in the economy – as growth slows – will provide some offset, but these will not be a sufficient headwind to prevent a material rise above the 2% target." said Lloyds Bank in a report.

British inflation has been below the Bank of England’s (BoE) 2 percent target for nearly three years. BoE policymakers adopted a neutral stance last month and are largely expected to keep interest rates on hold this week. Markets are betting that the path forward will lead up, with a greater probability of an increase than a decrease priced into futures contracts from June 2017. The direction and timing of the next move from BoE depends on the Brexit negotiations from the European Union.

“November inflation leaves the Bank of England with a juggling act of supporting the economy as the country rides through Brexit related uncertainty while preventing inflation from spiking higher. The central bank is expecting inflation to rise to nearly 3% in 2018 but will most likely keep interest rates on hold at their historic low this month.” said Chris Williamson, Chief Business Economist, IHS Markit.

GBP/USD was trading 0.17 percent higher on the day at 1.2689 at around 1110 GMT. The sterling was higher against the euro, EUR/GBP was down 0.24 percent on the day at 0.8360. FxWirePro's Hourly Currency Strength Index was also showing strength in GBP, with GBP Spot Index at 68.6772 (highly bullish) at the said time. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens