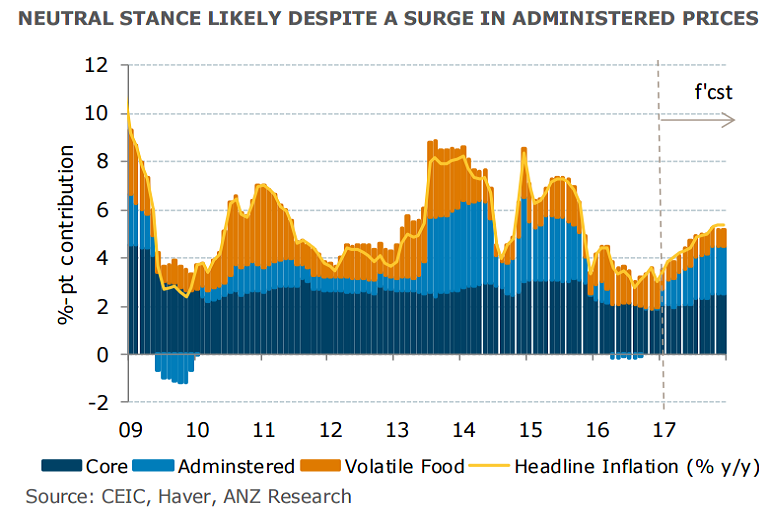

Indonesia's annual inflation rate increased in February, data from the statistics bureau showed on Wednesday. Indonesia's February annual headline inflation climbed 3.83 percent compared with January's 3.49 percent. The rise was slightly less than the 3.90 percent expected in a Reuters poll.

On a monthly basis, the consumer price index was up 0.23 percent in February. Core inflation which excludes administered and volatile food prices also picked up in February, to 3.41 percent from 3.35 percent in the previous month.

The rise in February inflation was largely driven by increases in electricity tariffs. Higher prices for processed and raw foods as well as healthcare also provided a significant contribution to the rise in annual inflation.

Looking ahead, Indonesia's inflation is likely to rise further as government proceeds to gradually remove electricity tariff subsidies for around 18.7 million recipients. ANZ estimates a further 0.8 percentage point addition to headline inflation from this move.

"We estimate that headline inflation is likely to periodically test the upper bound of Bank Indonesia’s (BI) inflation target in H2 2017. The official forecast corridor of 4% +/- 1% is, however, likely to be respected for the year as a whole," said ANZ in a report.

Indonesia's central bank (BI), which cut its key rate six times in 2016, targets annual inflation to be between 3 and 5 percent during 2017. The central bank's next policy decision is due on March 16th. With expectations for growth on a firmer footing and inflation firmly in check, ANZ expects BI to remain on hold through 2017.

USD/IDR was 0.25 percent higher no the day at 13371 at around 1200 GMT. Short-term trend in the pair is neutral. At the time of writing, FxWirePro's hourly USD strength index was highly bullish at 141.032. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated