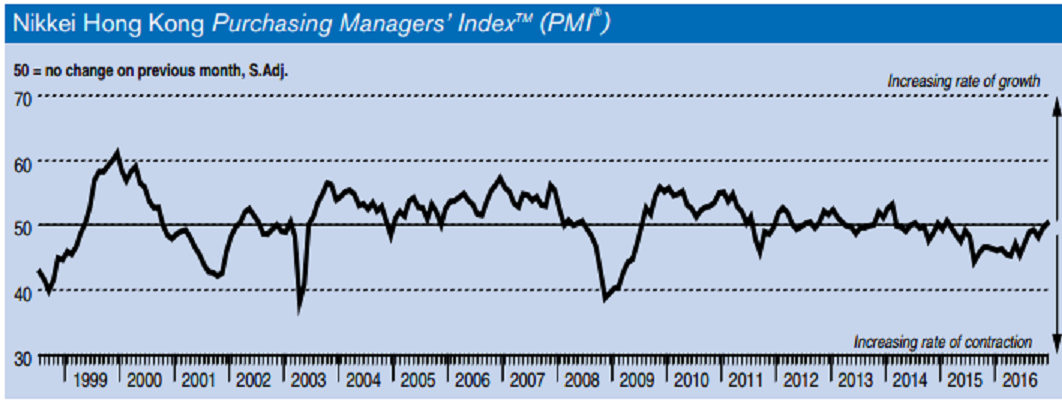

Hong Kong’s private sector is pulling out of recession, with the December PMI recording above the neutral 50.0 level. However, the improvement was not driven by expansions in output and new orders. Instead, a surge in the preproduction stock levels, underpinned by a marked increase in purchasing activity, boosted the headline PMI.

The seasonally adjusted headline Nikkei Hong Kong Purchasing Managers’ Index (PMI) recorded 50.3 in December, up from 49.5 in November. While the pace of expansion was only marginal, it represented the first improvement in the health of Hong Kong’s private sector since February 2015.

Volumes of new business placed at Hong Kong private sector firms nonetheless fell for the twenty-first month in December, reflecting weak client demand. This was accompanied by a further decrease in new orders from mainland China, though the pace of decline was slowest in three months.

Encouragingly, Hong Kong private sector business stepped up their purchasing activity during December in anticipation of greater demand in coming months. The increase in buying activity was the sharpest since February 2014, as some panellists pointed out stronger demand from new projects.

At the same time, suppliers were busier in December than in November, with vendor performance falling back into deterioration after improving in the first two months of the fourth quarter. However, anecdotal evidence suggested a lack of available suppliers was behind longer delivery times.

Meanwhile, companies were not optimistic enough to take on additional workers. Employment across the Hong Kong private sector was lower in December.

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock