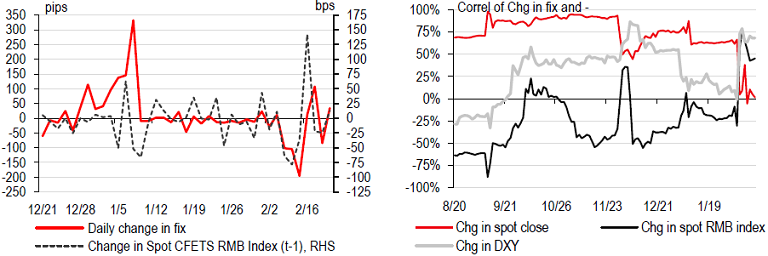

Some subtle but notable changes are seen in PBoC's FX policy after China's return from the New Year holiday on 15 February. PBoC's daily USD-CNY fixings have been showing larger two-way volatility after a period of stability amid the January market turmoil. The daily fluctuations have not been in line with the changes in the onshore 4:30pm closing price and the correlation of the daily change in the fixing versus the overnight movement in the China Foreign Exchange Trading System (CFETS) RMB index has risen.

Markets were speculating that the exchange rate would be kept stable before the meeting of the Group of 20 central bankers and finance ministers, due on Feb. 26 and 27 to discuss issues including China's excess capacity, oil prices and global growth. The move reiterates the Central Bank's intention on making the RMB more flexible.

PBoC Governor Zhou Xiaochuan in an interview with China's Caixin magazine published on 13 February had said that yuan's volatility versus the greenback will increase and the exchange rate is basically stable against the basket. CFETS noted that a combination of midpoint fixing from the central bank and the trade-weighted yuan exchange rate index was critical to the yuan's future reference in 2016.

"This shift in FX policy is a natural consequence of some improving risk appetite and a broadly stable USD, but it may also be a reminder, ahead of the G20 meeting on 25-26 February, that China is intent on making the RMB more flexible, and the CNY reference basket will draw out this message", notes HSBC in a research report.

Governor Zhou Xiaochuan will hold a news conference ahead of the meeting on Feb. 26 to answer questions from the media which could dispel recent confusion over China's yuan policy. Zhou had highlighted in the Caxin interview that China will not introduce capital controls, as it would be totally against the country's economic/financial reform agenda. Administrative measures to prevent speculative outflows have been and will continue to be implemented, but China will not reverse its path to internationalise its currency and liberalise its capital account.

"The RMB is expected to weaken further this year amid multiple episodes of "ease-then-squeeze", to gradually correct the currency's overvaluation and to help promote greater currency flexibility", adds HSBC.

Yuan eased against the dollar on Wednesday after the central bank fixed a softer midpoint. The spot market CNY opened at 6.5303 per dollar and was changing hands at 6.5307 at midday, while the offshore yuan CNH was trading 0.09 percent weaker than the onshore spot at 6.5364 per dollar. The onshore yuan softened 0.2 percent against the euro by midday at 7.1998. It also eased 0.3 percent against the Japanese yen, hovering at 5.8400 to 100 yen.

Changes in China's FX policy reiterate the Central Bank's intention for a more flexible RMB

Wednesday, February 24, 2016 11:36 AM UTC

Editor's Picks

- Market Data

Most Popular

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand