Change in China’s Forex reserves has to a large extent been a reliable and timely indicator to show China’s capital flows. However, Forex reserves cannot be the sole indicator to assess capital flows as valuation effects could bring significant impact to the FX reserves. China's cross-border payments could divulge more details of the pattern of outflows.

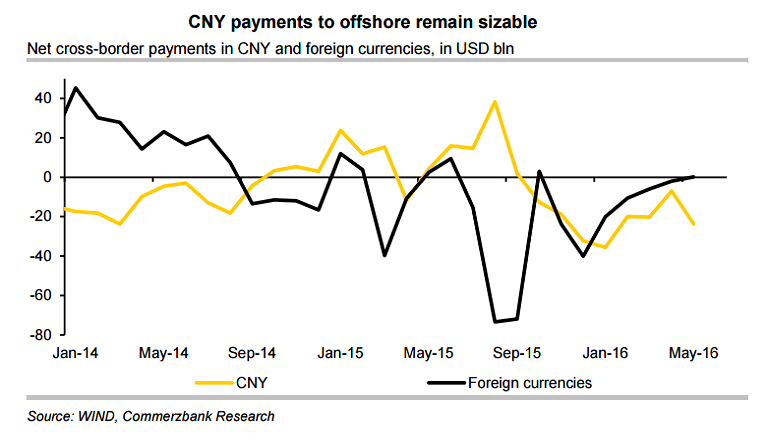

Chinese authorities have implemented strict controls and closely monitor the payments of foreign currencies. CNY cross-border payments, on the other hand, are much easier as the authorities see the outflows of local currencies are not as harmful as outflows of foreign currencies. China's net cross-border payments have been negative for ten consecutive months since last August “one-off devaluation” in CNY.

Even as net payments in foreign currencies have narrowed significantly in recent months, the net payments to overseas in CNY remains sizable. As the USD purchase transactions have been strictly regulated in onshore market, some corporates and residents transfer their CNY to overseas for FX conversion. USD-CNH rates have moved higher and CNY payments to offshore market are seen as the driving force. CNH deposits in Hong Kong continued to drop in the past three-quarters. Cost of CNH funds also remains low despite smaller CNH funding pool, indicating falling demand for CNH.

“Capital outflows have been continuing at pace and they are a lot larger than what the authorities would have us believe through the official data,” said Sue Trinh, Hong Kong-based head of Asia FX strategy at the Royal Bank of Canada.

Data released by the People's Bank of China (PBoC) showed on Thursday that China's foreign exchange reserves in June unexpectedly rose $20 billion to $3.21 trillion, rebounding from a 5-year low in May. Data indicates that the PBOC didn’t heavily intervene in the currency market last month as it let the yuan depreciate in accordance with market supply and demand.

As the PBOC continue to let the renminbi (yuan) slide against the dollar and demand for CNH continues to dwindle, serious concerns over the trajectory of the currency could re-emerge. The net payments to overseas normally picked up when CNY weakened in a faster pace and this could lead to another surge in capital outflows.

"All in all, China still faces significant capital outflow pressures, implying that further depreciation in CNY is inevitable. Notably, a weakening outlook on CNY will have negative consequence on the offshore market developments as well," said Commerzbank in a report.

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?