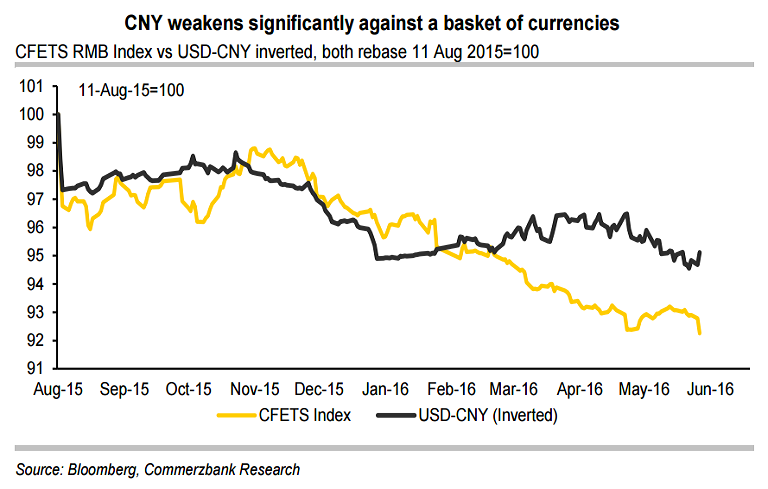

Recent movement of CNY exchange rate seemingly points to PBoC’s tactics. Historic data shows that the CNY has depreciated by more than 4.5% YTD against a basket of currencies and the USD-CNY fixing rates in the past few weeks reveal that China’s central bank intends to guide its currency to the weak side.

At the US-China 8th Strategic & Economic Dialogue, China reiterated its commitment to FX reforms (and to improve economic data and transparency) and the US noted China's improving communications on its FX policy. RMB internationalization is an additional incentive for the Chinese authorities to stay on the path of financial and FX reforms. Furthermore, with the Fed likely to move slower on raising rates, there is more scope for the RMB exchange rate to become more market determined.

PBoC data showed on Tuesday that China's foreign exchange reserves in May fell to $3.19 trillion, the lowest since December 2011. Economists polled by Reuters had predicted a fall to $3.20 trillion from $3.22 trillion at the end of April. Prior month data show that the reserves rose by $7.1 billion in April and $10.3 billion in March. The decline in FX reserves in May was largely due to unfavourable valuation effects as the USD strengthened in the month. In SDR terms, China’s FX reserves rose by SDR3.5bn in May. Stabilizing FX reserves which show easing capital outflows release the depreciation pressure on CNY exchange rate for the time being.

On the one hand, the PBoC tries to weaken its currency against the major trade partners to regain trade competitiveness, while on the other hand, it could also be preparing for possible rate hikes from the US Fed. That is, if USD strengthens following the rate hikes, China could maintain a stable USD-CNY exchange rate to prevent the speculation of a rapid CNY weakness. In this case, CNY will have to appreciate against the currency basket – the 4.5% depreciation so far will provide some room for China to manoeuvre. PBoC still holds net USD27-28bn equivalent short USD positions in the FX forward market, and could opt to unwind some of these positions to weaken its currency.

"We believe that China still wants to see a “managed depreciation” in the CNY exchange rate. We thus maintain our forecast that USD-CNY will reach 6.65 by the end of this year." said Commerzbank in a report.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand