The almost mystical Green Climate Fund is back in the headlines at the COP26 climate summit in Glasgow. The fund grew out of a promise made by rich nations in 2009 to provide US$100 billion (£74 billion) per year in “climate finance” to help developing countries to decarbonise their economies. So far, the amount actually raised has fallen far short, though we might at least get there soon.

Climate finance is notoriously tricky to define. It’s rarely clear how much is really available, or how much is actually needed. So where does this money come from, and can those richer nations even afford it, especially following the COVID-19 pandemic?

The lack of a consistent, globally accepted definition of what counts as climate finance has led to a wild west scenario, making it impossible to calculate how much is really out there and how environmentally friendly it really is. Governments and fund managers alike can attach “green” labels to investments in new airports or “green” funds with large stakes in fossil fuel companies. Some of this is likely to be blatant greenwash. But some of it simply reflects real-world complexity: if fossil-fuel majors raise finance to decarbonise their portfolios by building wind and solar farms, should this be considered “green”?

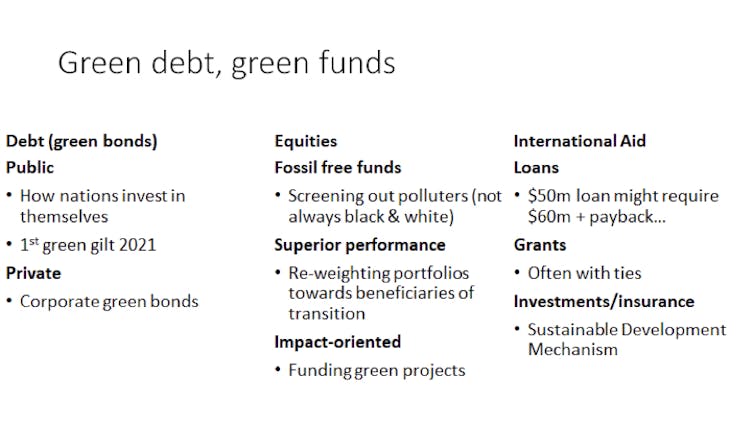

There are three broad categories of climate finance. The first is debt, which can be public (governments issuing bonds) or private (companies issuing bonds). A second category comes from shares and private capital. This can take many forms, but often includes “green funds” that screen out polluting firms and industries.

The final category, and one that is a key interest at COP26, is the role of international aid in providing finance to help developing countries decarbonise –for example by phasing out coal, developing low-carbon transport, or restoring ecosystems such as mangroves that buffer against floods and storms.

In principle, climate-oriented international aid can take the form of grants, loans or direct investments and insurance, each with varying degrees of strings attached. In practice, however, these categories are highly controversial. Take for example a hypothetical US$50 million loan from the US to India for a new solar farm, which is to be repaid with US$10 million in interest. From the US perspective, US$50 million of climate finance has been provided. From India’s perspective, it received US$50 million but will ultimately send US$60 million to the US, prompting the question of who is financing whom.

Three categories of climate finance. Kamiar Mohaddes et al, Author provided

What is the Green Climate Fund and does it matter?

At COP15 in Copenhagen in 2009, rich countries promised to provide US$100 billion a year by 2020, which led to the formal establishment in 2010 of the Green Climate Fund with the aim to support developing economies to address climate change. Whatever metric or definition of climate finance you use, we have clearly not achieved the goal of US$100 billion a year yet. That figure will instead be reached in 2023 according to the latest estimates, though some at COP26 are more optimistic: both the EU’s Ursula von Leyden and US climate envoy John Kerry have said the goal will be met in 2022.

A tree planting project in Rwanda, financed by the Green Climate Fund. Rwanda Ministry of Environment, CC BY-SA

However, because there’s no clear definition of what counts as climate finance, there are huge discrepancies in estimates of what has been committed so far. The OECD estimate (which is what the COP26 climate finance delivery plan is based on) is at the upper end, while Oxfam estimates that just over one-fifth of what has been promised has materialised so far.

How much is actually needed

Estimates of the amount of finance needed to actually decarbonise the global economy range between US$50 trillion and US$90 trillion. With a thousand billions in a trillion, that US$100 billion everyone is referring to is merely a decimal point.

It is also near impossible to figure out exactly how much green finance will be needed, since the total amount required depends on where the money goes and how soon we spend it. Early investments in new technologies generate rapid cost reductions and will reduce asset stranding (wasted investments in already obsolete carbon-intensive infrastructure). Further delay simply slows innovation and compounds the climate crisis.

Climate change will shrink the economies of rich, poor, hot and cold countries alike and will make it more difficult and more expensive to raise the finance needed to decarbonise in the future. The cost of early action is far cheaper than the cost of delayed action.

We have just seen a comprehensive and coordinated cross-country policy response to the pandemic, with more than US$16 trillion of government support rolled out globally (and at super-fast speed). Climate change will require the same coordinated response, and the pandemic response shows that significant financing for decarbonisation can be relatively quickly mobilised.

The bottom line is that mobilising climate finance is a win-win for both the developed and developing economies. And in the context of what will really be needed to address climate change, that US$100 billion is really just a distraction.

Kamiar Mohaddes receives funding from the Keynes Fund and INSPIRE.

Kamiar Mohaddes receives funding from the Keynes Fund and INSPIRE.

Matt Burke receives funding from the INSPIRE Network.

Matthew Agarwala receives funding from the ESRC, The Productivity Institute, and the INSPIRE Network.

Patrycja Klusak receives funding from the INSPIRE Network.

Kamiar Mohaddes, Associate Professor in Economics & Policy, University of Cambridge

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves