Wholesale inventories in US are expected to increase by 0.4% MoM in April from 0.1% in March.

The main event this week though is the release of retail activity on Thursday.

The Fed will be in a lockout period most of this week ahead of next week's FOMC meeting.

Shorting interest is seen on dollar side ahead of retail activity announcements.

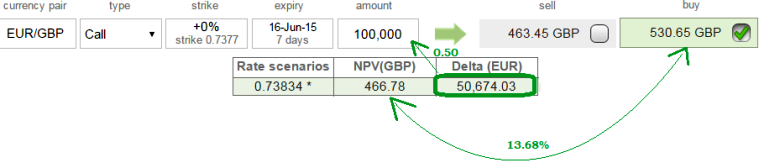

We recommend delta hedging below 1.1284 levels on EUR/USD ATM calls as they are well priced trading below 15% Net Present Value.

Underlying positions should be added only above stated pivot point. Use equivalent spot Fx positions. However, add longs only on every dips.

This derivative instrument on EUR/USD pair seems to offer reasonable risk appetite as sensible Risk Reward Ratio is popping up on this ATM instrument.

The above instance in diagram, evidences option priced in below 15% of NPV (13.68%), which we deem this instrument as optimal entry point at current juncture.

Delta hedging on At-The-Money calls of EUR/USD

Tuesday, June 9, 2015 8:09 AM UTC

Editor's Picks

- Market Data

Most Popular

3

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings