It has been a quiet week of price action among crypto-avenues as the major crypto pairs, such as, Bitcoin and Ethereum price plunging by 2% and 1% respectively.

But for now, crypto markets appear to be healthier after a minor price dip in the recent past following news that US authorities (CFTC) had filed charges against Bitcoin derivatives exchange, ‘BITMEX’ and its founders of allowing unregistered trading and ongoing violations of US anti-money laundering laws.

As a result, the underlying price of Bitcoin plummeted to as lows of USD10,431 on October 2nd but subsequently ended the week near the USD10,600 levels.

Five entities and three individuals that manage the exchange were charged with violating multiple CFTC regulations including failing to implement anti-money laundering procedures. Nonetheless, the platform is reportedly operating their business (withdrawal and deposit requests) usually. The open interest (which is an indicator of capital flowing in an out of a market) in Bitmex dropped by 16% following the announcement of the charges, and hit a fresh low at 45,112BTCs YoY. Additionally, 48,400 BTCs - or about 25% of the total Bitcoin held by the exchange - was withdrawn by Bitmex traders.

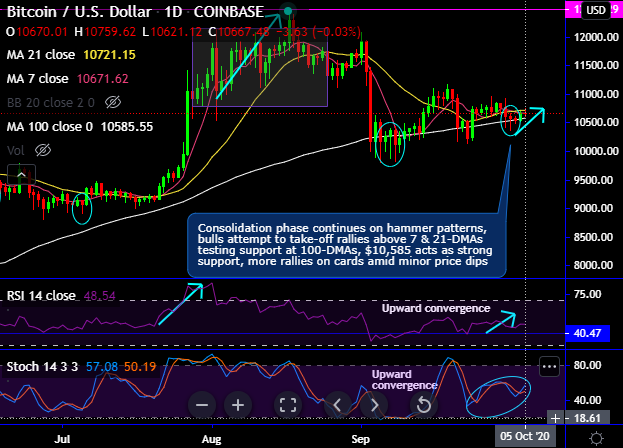

Technically, the consolidation phase continues on hammer patterns, bulls attempt to take-off rallies above 7 & 21-DMAs testing support at 100-DMAs, $10,585 acts as the strong support. For now, more rallies are the on cards amid the minor price dips.

Since mid-March, bitcoin’s consolidation phase has been considerably striking a chord among the investors’ communities. BTC has spiked from $3,858 to the recent highs of $12,486 (Aug 17) which is 226% rallies.

Accordingly, the long hedges have been advocated using CME BTC Futures (when spot reference was at $4,927 levels). It is unwise to bet on speculating the next upside target and accumulate fresh bitcoins. Instead, one can certainly uphold the above advocated long hedges using December’20 deliveries. Courtesy: CFTC, Tradingview & BNC

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential