Eurozone’s household demand is expected to improve and with German car production seen to normalise shortly, the slowdown in business investments will have material effect on GDP growth, which is now expected to be 0.8 percent this year (previously 1.3 percent). Next year growth is seen at 1.2 percent, 0.2 percentage point lower than the previous forecast, according to the latest research report from DNB Markets.

The eurozone has continued to underperform in this year’s first quarter. The persistence of external uncertainties, such as Brexit, the US-China trade war, and the US threatening to impose tariffs on European cars, has weighed on sentiment, causing firms to shelve investment plans, particularly in Germany. Indeed, the latest PMIs point to a material decline in business investments in coming quarters.

"While we expect many of these issues to be resolved, it will at best lead to a small rebound in investments next year, rather than this year. In addition, domestic uncertainties, such as political instability in Italy and reform-battles in France, are adding to the uncertainty and thus negatively affecting economic growth," the report further commented.

Germany appears to be especially vulnerable to external threats. Granted, while it does not face the same source of domestic instability as Italy or France, its export-oriented economy is more vulnerable to external shocks and weaker demand abroad than the rest of the eurozone, with exports accounting for more than 50 percent of GDP.

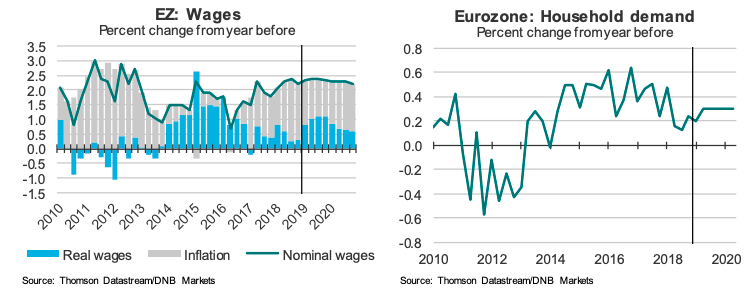

Inflation has fallen markedly in recent months, and is expected to continue moderating on the back of slower growth in energy prices. While this is negative for the ECB, who targets bringing inflation up to 2 percent, it is positive for households who get higher real wages.

"While we still expect a rebound in household consumption this year, the improvement is set to be smaller than previously thought. Next year we expect growth at 1.2 percent, 0.2 percentage point lower than our previous forecast," DNB added.

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality