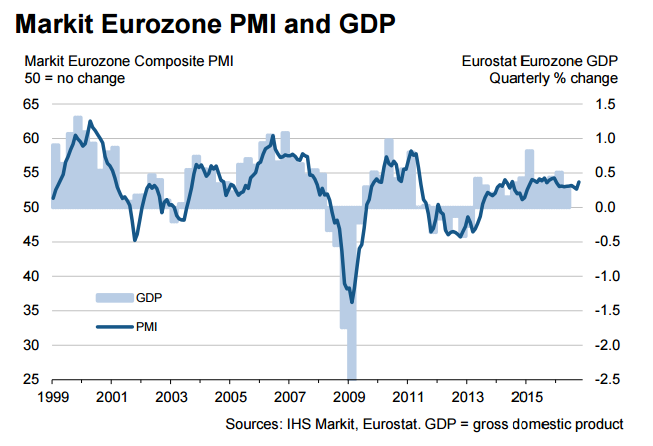

Eurozone flash PMI data released earlier today showed that suggested that the region's economic recovery strengthened over the course of October. IHS Markit's purchasing managers’ index (PMI) used by the European Central Bank (ECB) to assess the health of the region’s economy, rose to 53.7 in October, up from 52.6 in September, well above consensus expectations for a reading of 52.8 and the highest seen so far this year.

Details of the report highlighted divergence between the region's two largest economies. German growth gained significant momentum to show the second-largest monthly increase so far this year. By contrast, the pace of growth slowed in France. Elsewhere, output growth across the rest of the region revived from September’s 21-month low but remained one of the weakest expansions recorded over the past two years.

"The Eurozone economy showed renewed signs of life at the start of the fourth quarter, enjoying its strongest expansion so far this year with the promise of more to come. With backlogs of work accumulating at the fastest rate for over five years, business activity growth and hiring look set to accelerate further as we head towards the end of the year," said IHS Markit chief business economist Chris Williamson.

The Eurozone economy is likely to continue to strengthen in coming months as indicated by faster growth of orders books and acceleration in the pace of hiring. Details of the report showed new order growth was the highest since January, prompting firms to take on extra staff. Employment showed the biggest gain for three months. Average prices charged for goods and services rose for the first time since August 2015 on firming demand.

“October’s PMI is consistent with a quarterly GDP growth rate of 0.4%, adds Chris Williamson.

October also saw the extent of manufacturing supply chain delays hit one of the highest in five years. Supply shortfalls usually lead to a rise in prices. Signs of both stronger economic growth and rising price pressures and the expectations of a robust Q4 could fuel speculation of QE tapering by the ECB.

EUR/USD was trading at 1.08920 at around 12:00 GMT. The major has shown continuous downside for the past ten trading sessions. On the lower side, major support is around 1.08475 (161.8% retracement of 1.1045 and 1.13660) and any break below targets 1.0820 (Mar 10th 2016 low)/1.0775. The pair immediate resistance is around 1.0902 (23.6% retracement of 1.10392 and 1.08953) and any break above will take the pair to next level till 1.09500/1.09715.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances