Recently there has been some concern over Euro/Dollar trade, while some analysts are pointing out that Euro might take further dip, especially with further easing from European Central Bank (ECB) as early as tomorrow, whereas others are pointing to Euro might be too over-shorted.

We, thought it would be good idea to evaluate the confusion, from fundamental point of view.

In our pursue for fundamental evaluation we look at the following -

- Big Mac index

- Purchasing power parity

- Long rates

- Short rates

- Ultra-short rates

- Policy divergence

- Current account

In our previous fundamental evaluation article we have already reviewed Euro and Big Mac and this one we focus on policy divergence.

Why policy divergence?

In today's financial world, central banks are a major player. Since financial crisis, major central banks around the world has pumped up liquidity worth $25 trillion. Now. After six year since the crisis, some central banks are considering to reverse course, while others are still pumping liquidity.

With balance sheet size in trillions of Dollars, these moves are enough to cause ripples in the market. May even cause tsunami, if the bank fails to manage their balance sheet reversal well.

Hence it is worth taking a look at Euro in the light of policy divergence.

Policy divergence between ECB and FED

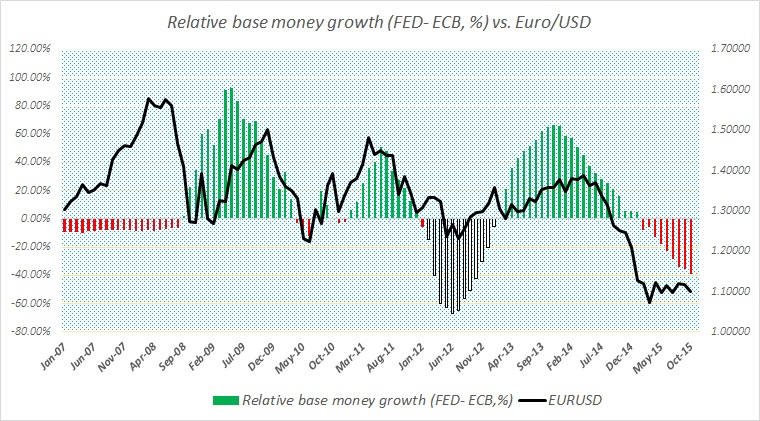

As shown figure, Euro/USD since the crisis is showing high level of correlation with relative monetary policy divergence as measured in rate of changes in base money. While adjusted base money size is much higher than European Central Bank's (ECB), this year pace growth in base money have started to outpace that of FED's.

FED since last year has stopped purchasing assets, while European Central Bank (ECB) is about to build up on its current pace of purchase of € 60 billion per month, at tomorrow's meeting.

If ECB, do increase the pace of purchase, divergence will further intensify, building downside pressure on Euro against Dollar.

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist