EUR vol risk reversals remain low compared to the level of rates (refer above diagram). Also, in longer tails, the EUR volatility smile remains flat compared with the rates vs vol correlation seen since 2015 and over the past week (refer above diagram).

Despite the risk that the EURUSD correction goes further (it really hasn't gone very far yet), we're still very keen on EURJPY as a long-term long. As per the forecasts, a peak at 140 at the end of the year, and while that looks miles away it does remind that there is a lot to play for.

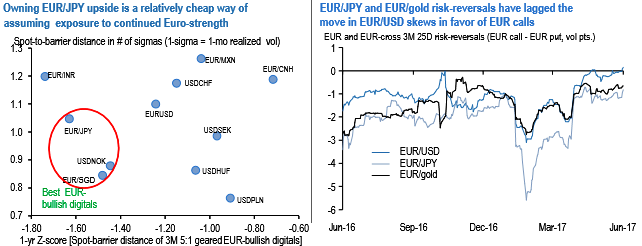

EURUSD risk-reversals flipped positive (bid for EUR calls) this week in sub-3M expiries in response to Euro strength, but there are still two laggards among Euro-crosses that are bid for EUR puts and have room to play catch-up if Euro strength continues: EURJPY (3M 25D r/r -0.8mid) and EUR/gold (3M 25D r/r -0.65 mid). Spot-vol correlation performed strongly positively this week and supports a narrowing of the EUR call discount: a 2.9% rally in EURJPY was accompanied by a 0.85 %pt. jump in 3M ATM, while a2.5% rally in EUR/gold led to a +0.4 vol uptick.

The obvious appeal of EUR-cross skews is that they earn smile decay while waiting for a re-pricing; they also avoid exposure to a Fed-driven bounce in the dollar, which isn’t looking much of a problem at the moment but has a low bar for resurfacing given the dollar’s substantial rates/FX disconnect and extended duration length in Treasuries.

According to JPM, the directional view of moderate gold weakness in H2 is more amenable to bullish Euro risk-reversal plays on crosses than the more constructive outlook on JPY, but even the latter may have room for near-term slippage amid widening Japan vs. rest of the world rate differentials and firmer equity market sentiment.

The steepness of the EURJPY risk-reversal curve renders back-end tenors better shorts, however, we prefer sticking to 2017 expiries (6M) since 2018 dates come with unpredictable Italian election risk. The EUR/gold risk-reversal curve is much flatter in comparison hence short tenors work fine. We enter short 6M 25D EURJPY risk-reversals (delta-hedged).

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data