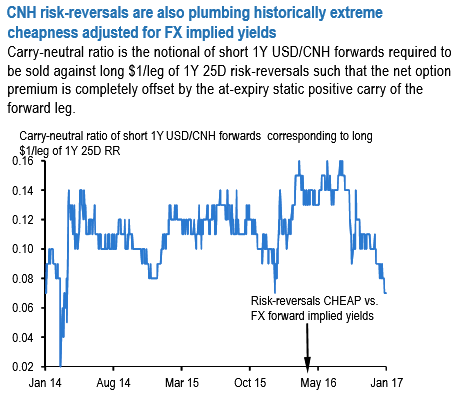

The cheapness of CNH risk-reversals relative to implied yields is also plumbing a historical extreme (refer above chart), as gauged by the carry-neutralizing forward delta-hedge ratio (the notional of short USDCNH forward partial delta-hedge needed to be combined with long unit notional/leg of a risk-reversal such that the option premium is completely paid for / offset by the static carry on the forward leg).

As difficult as it is to stomach during a week of pain on dollar longs, the risk reversal set-up suggests that a carry efficient way of resetting medium-term short China positions is to buy USDCNH risk-reversals hedged with a tiny amount of short forwards.

The chart above shows that this carry neutralizing forward notional is only 0.07 for a 1Y 25D riskie at current market, suggesting that a package of (long $100mln/leg of 1Y 25D RR + short $7mn of 1Y forward) yields $43mn (=$50mn of BS delta from the option –$7mn of the forward) of carry-free delta, which is a luxury in an environment of 6% + negative carry in forwards.

What about CNY vol itself? There is a case to be made that elevated carry/vol makes owning USDCNH straddles appealing as static carry on the USD put leg of the straddle stands to recoup more than 90% of option premium in unchanged markets. The fly in the ointment is that realized vols (excluding this week’s) have consistently clocked 3% 4% below ATMs for most of the past year, and vega profits have only accrued during periods of heavy directional demand for USD calls. The latter will perhaps only return after the current position squeeze has run its course, so we reckon better risk-reward for longs will emerge at or below 7.0 on 1Y ATM vol.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate