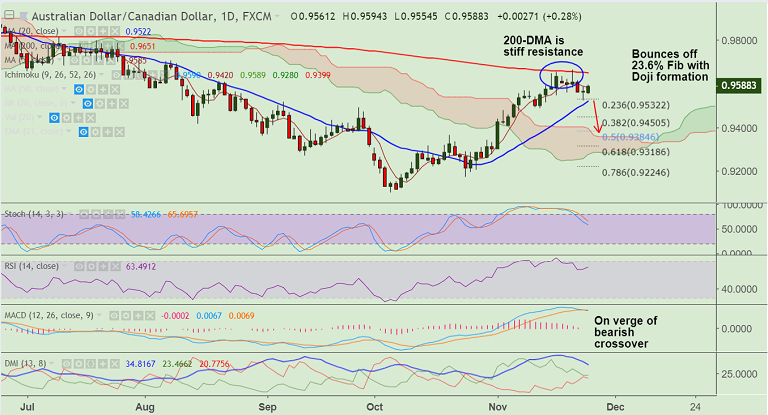

AUD/CAD chart on Trading View used for analysis

- AUD/CAD is trading 0.20% higher on the day at 0.9586 at the time of writing.

- The pair has bounced off 23.6% Fib support on Friday's trade and has edged above 5-DMA.

- We see a Doji formation at 23.6% Fib support which raises scope for further upside.

- The pair is in a near-term bull trend and breakout at 200-DMA could see further upside.

- On the flipside, 20-DMA is strong support and break below will see further weakness.

- Focus now on Australia Capex data for further impetus. Markets expect a +1.0% q/q rise for Australia’s Q3 real private capital expenditure (capex).

Support levels - 0.9532 (23.6% Fib), 0.9522 (20-DMA), 0.9450 (38.2% Fib)

Resistance levels - 0.9651 (200-DMA), 0.9664 (Nov 21 high), 0.97

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025