Chart - Courtesy Trading View

AUD/NZD was trading 0.10% higher on the day at 1.0608 at around 12:30 GMT.

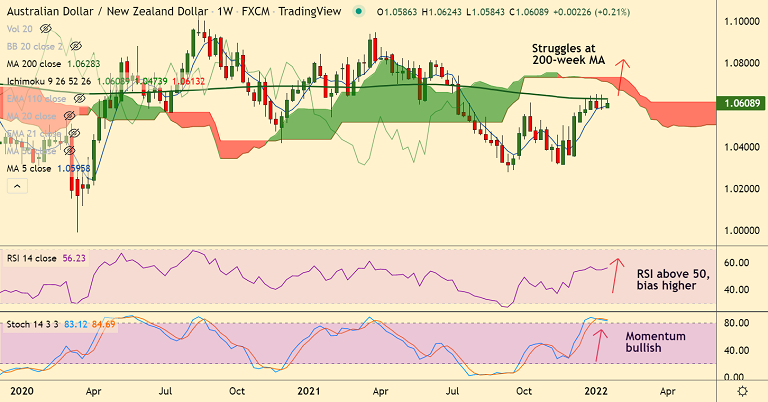

The pair has been struggling to break above 200-week MA resistance from the past five weeks.

Technical bias is bullish. The GMMA indicator shows major and minor trend are bullish and the pair trades above 200-DMA.

A record high number of covid-led deaths in Australia and geopolitical risks emanating from Russia keep the antipodeans depressed.

That said, Ratings agency Fitch says China growth should improve during the second half of 2022, keeping hopes for recovery.

Support levels - 1.0588 (21-EMA), 1.0561 (200-DMA), 1.0537 (55-EMA)

Resistance levels - 1.0628 (200-week MA), 1.0673 (Upper W BB), 1.07

Summary: AUD/NZD finds major resistance at 200-week MA. Technical studies are biased higher. Watch out for decisive break above 200-week MA for further upside.