AUDUSD medium term perspectives: It is worthwhile to watch the key 0.8000 level breach for the day – will it attempt another break above, as it did last night? AU GDP will be key today, as will be USD direction.

As the RBA remains firmly on hold, as widely expected, and the US dollar rises on tighter Fed policy, then AUDUSD could fall to 0.76 by year end.

OTC outlook and Options Strategy:

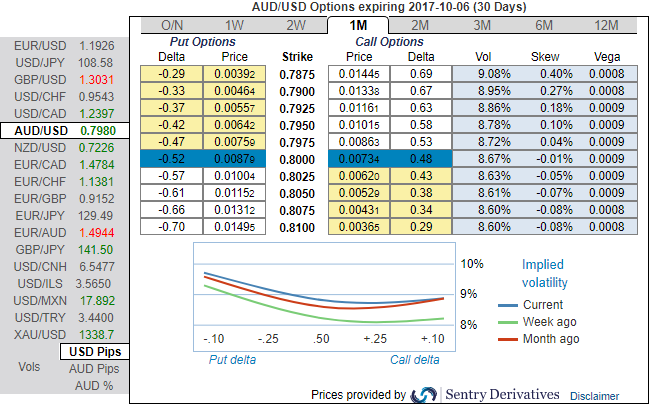

Please be noted that the positively skewed IVs of 1m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.7875 levels (refer above diagram).

While bearish neutral delta risk reversal divulges the interests in hedging activities for downside risks remains intact amid mild upswings.

Well, the bearish stance has been substantiated by AUDUSD's rising IV in 1-3m which is an opportunity for put longs in long term and using shrinking IVs of shorter tenors with bearish neutral delta risk reversal can be interpreted as an opportunity for writing OTM puts or Theta shorts in short run as the spot FX market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Accordingly, we had advocated put ratio back spreads a couple of days ago, wherein short leg is functioning as the underlying spot FX keeps spiking.

So, the speculators and hedgers for bearish risks are advised to capitalize on the prevailing rallies and bid on 1-3m risks reversals to optimally utilize Vega longs.

We advocate weighing up above aspects and uphold the same option strategy on hedging grounds, we eye on loading up with fresh Vega longs for long term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1%) OTM put option as the underlying spot likely to go either sideways or spike mildly, simultaneously, go long in 2 lots of vega long in 2m ATM -0.49 delta put options.

A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium. However, Theta (time decay) also increases especially as expiry approaches. Hence, OTM shorts in calls in such scenario are most suitable for speculation.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings