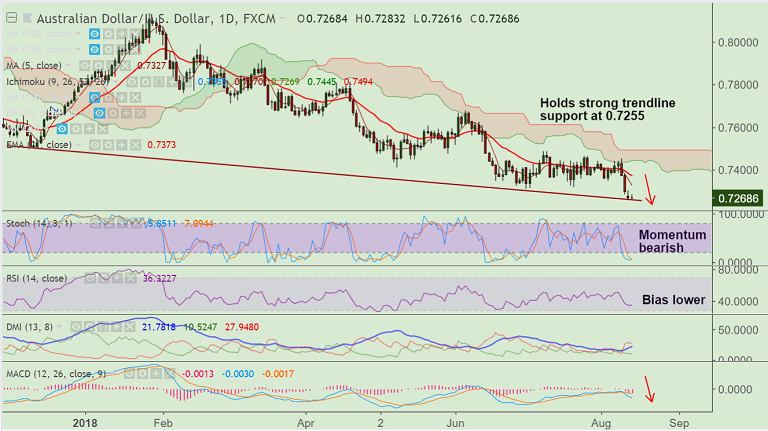

Refer AUD/USD chart on Trading View

- AUD/USD is trading in an extremely narrow range, holds above major trendline support at 0.7255.

- Aussie dented as China's Tuesday data dump comes in slightly below expectations.

- China's YTD Fixed Asset Investment for July came in at 5.5% missing forecast at 6.0%.

- Industrial Production y/y also missed projections, coming in at 6.0%, missing expectations at 6.3%.

- Retail Sales also came in at 8.8%, compared to forecast to remain steady at their last level of 9.0%.

- The pair has recovered from 19-month lows at 0.7256 and is currently trading at 0.7268.

- Minor recovery attempts capped below 0.73 handle, bias remains bearish. Break below 0.7255 to see further weakness.

- Aussie also weakens as a knock-on effect of risk aversion on the back of Turkish contagion angst.

- Further, the antipodean remains subdued after the Reserve Bank of Australia trimmed its inflation forecasts.

- Technicals remain bearish. Price action was rejected at 55-EMA and is hovering around minor trendline support at 0.7255.

- Break below will likely see test of 78.6% Fib at 0.7107. We see bearish invalidation only above 55-EMA.

Support levels - 0.7255 (trendline), 0.7160 (Dec 23 2016 low), 0.7107 (78.6% Fib)

Resistance levels - 0.7327 (61.8% Fib), 0.7328 (5-DMA), 0.7373 (21-EMA)

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -111.327 (Bearish), while Hourly USD Spot Index was at 113.417 (Bullish) at 0545 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.