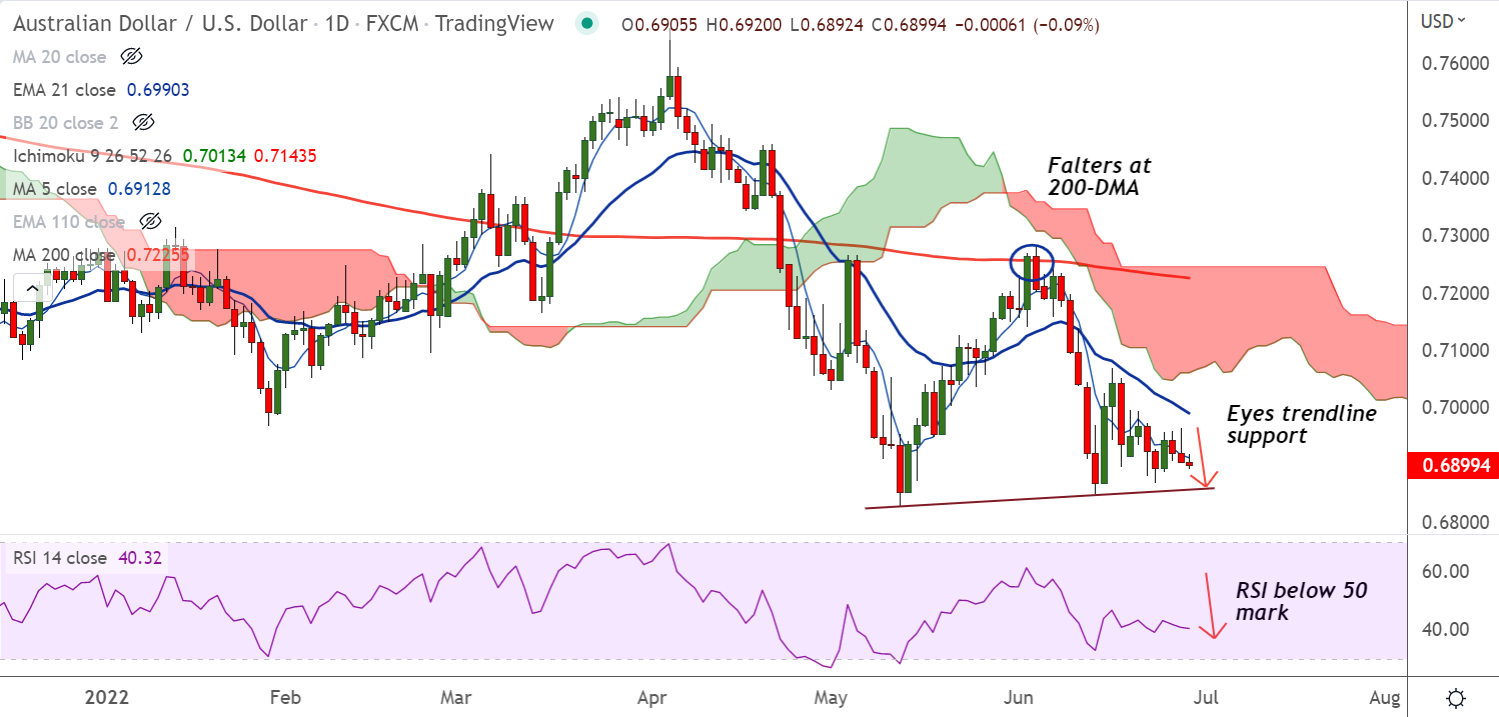

Chart - Courtesy Trading View

Technical Analysis:

- AUD/USD was trading 0.09% lower on the day at 0.6899 at around 05:50 GMT

- The pair has slipped lower from session highs at 0.6920, outlook remains bearish

- GMMA indicator shows major and minor trend are strongly bearish

- Momentum is bearish, 'Death Cross' on the daily charts keeps bias lower

Fundamental Overview:

Australia Retail Sales reprints 0.9% MoM growth, versus the market consensus of 0.4%, for May.

That said, fears surrounding global recession and the increasing inflation woes weigh on the antipodeans.

Western sanctions on Russia and tough conditions for China at the NATO meeting likely to exert additional downside pressure.

Data/ Event Watch:

- US Core Personal Consumption Expenditure (PCE) for Q1 2022, is expected to remain unchanged at 5.1%

- US Q1 GDP, is likely to confirm a 1.5% annualized contraction

- Fed chair Jerome Powell's speech at 13:00 GMT

Major Support Levels:

S1: 0.6855 (Trendline)

S2: 0.6828 (12 May lows)

Major Resistance Levels:

R1: 0.6912 (5-DMA)

R2: 0.6990 (21-EMA)

Summary: AUD/USD was trading with a bearish bias. Scope for dip till trendline support at 0.6855.