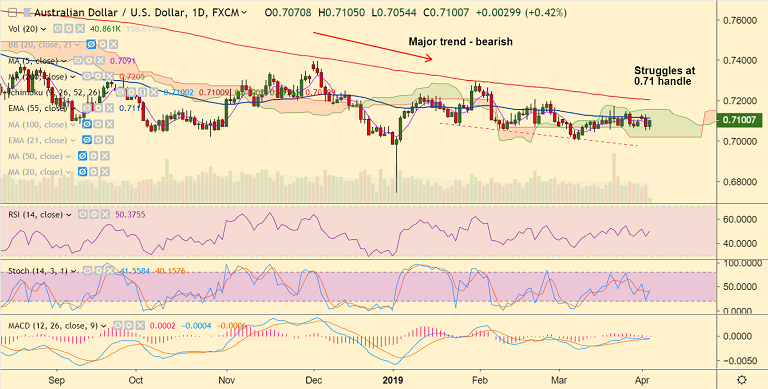

AUD/USD chart - Trading View

- Aussie bid in early Asian session on upbeat data from Australia, China and US-China trade optimism.

- China services PMI rose to 54.4 index points in March, beating an expected rise to 52.3 index points from February's reading of 51.1 index points.

- Also, Australia retail sales jumped 0.8 percent in February and the trade surplus widened to AUD 4,801 million.

- Talk of US-China closing on a trade deal and risk-on action in equities could keep the AUD better bid during the day ahead.

- Major trend in the pair is bearish and we recommend using minor rallies to add short positions.

- Immediate resistance is seen at 55-EMA and cloud top at 0.7114 and 0.7156 respectively. Bearish invalidation only above 110-EMA at 0.7205.

- Support align at cloud base at 0.7020, 0.70 and 0.6987 (lower BB - weekly)

Recommendation: Stay short on upticks around 0.71/0.7115, SL: 0.7160, TP: 0.7055/ 0.70

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.