The Antipodeans currency crosses are accumulating gains to the previous rallies on better than expected manufacturing surveys from top trade partner China even as local data disappointed in a busy regional day.

AUDUSD traded at 0.7541, up 0.29%, AUJPY continued its yesterday’s gains from 77.735 to the current 78.132 levels (0.51%). NZDJPY adds gains of 0.36%, from the previous close of 74.951 to the current 75.222 levels.

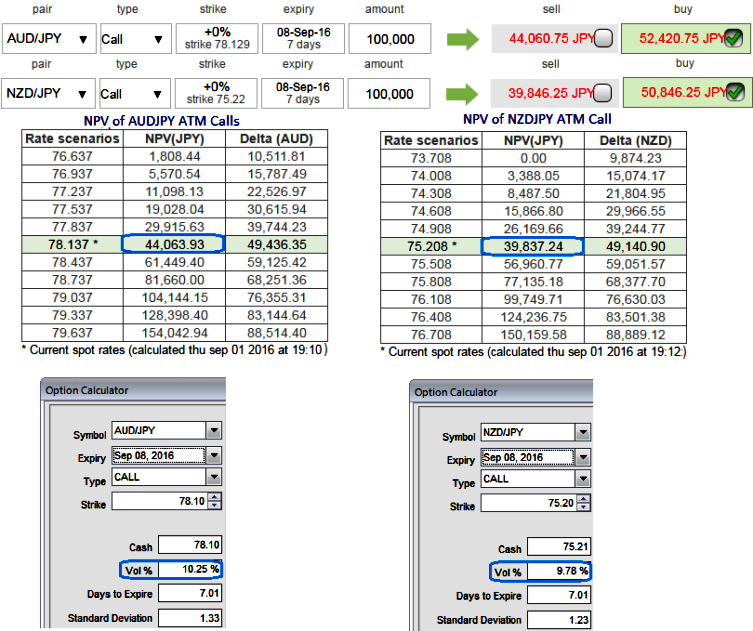

If you have to hedge AUDJPY’s upside risks, we recommend avoiding ATM calls as you can probably observe that these instruments seem to be overpriced when compared with 1w IVs.

ATM premiums of AUDJPY = 52420; Net Present Value = 44063; 1W implied volatilities = 10.25%

Thereby, calls are not advised as an optimal hedge as they are overpriced by 18.96% than the NPVs, whereas IVs of their tenors show just at 10.25%.

ATM premiums of NZDJPY = 50846; Net Present Value = 39837; 1W implied volatilities = 9.78%

Thereby, calls are not advised as an optimal hedge as they are overpriced by 27.63% than the NPVs, whereas IVs of their tenors show just at 9.78%.

Consequently, we advocate OTM instruments to mitigate potential upside risks as these instruments could serve as cost-effective hedging vehicles.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?