Despite the ruckus in the UK press over the inclusion of Gibraltar in the EU’s draft Brexit guidelines, the tone from both sides during the trigger of Article 50 was surprisingly cordial. The UK admitted that it could not “cherry pick” what it wanted from the EU, and the latter showed some flexibility in allowing talks on the “framework for the future relationship” once progress had been made on the divorce terms. So far so good, but the negotiations are likely to get more contentious and complicated soon.

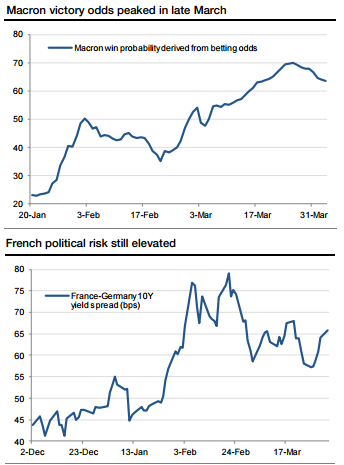

Across the channel, Macron’s momentum appears to be ebbing in recent opinion polls, as Fillon and Mélenchon edge forward (refer above chart). The shifting dynamics reminds us that French political risks should remain elevated into the first round vote on April 23. With Le Pen widely expected to make it through the crowded field into the runoff vote, thanks to her core support base, the identity of her challenger will shape market perception of the political risks (refer above chart).

Trump will host Chinese president Xi in Florida for their first meeting later this week. Xi is not known to play golf, and the meeting has been overshadowed by Trump’s tweet that it would be “very difficult”. The most positive thing to say is that expectations surrounding the summit are correspondingly low.

The only G10 central bank meeting this week occurs in Australia, but steady policy is expected. The FOMC and ECB minutes will be out, and it will likely be the latter that draws more attention given that market opinion on the ECB policy outlook is in a state of flux. The monthly PMI readings will be released this week, and we will cap it off with the US payrolls report.

The list of key market events this week includes:

Apr 4: RBA meeting, UK construction PMI, US factory orders, and US durable goods orders.

Apr 5: France-Germany-EA services PMI, UK services PMI, US ADP report, US nonmanufacturing ISM, and FOMC minutes.

Apr 6: Germany factory orders, Switzerland CPI, and ECB minutes.

Apr 7: UK industrial production, UK trade balance, Canada employment report, and US employment report.

The two major euro crosses are approaching key technical support levels. Our technical analysts highlight technical support for EURGBP at 0.8445, while EURUSD has trendline support just under 1.06. Look to buy EURGBP at 0.8460 on a further dip, targeting 0.8700 initially with a stop at 0.8330.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand