In this write-up, we focused on a few markets in the Asia equity space to hedge against the North Korea risk. Contemplating what if the North Korea rigidities transform into a military clash? As a result, all equity markets would be vulnerable but there should be some gradation in their vulnerability.

A higher weighting is given to developing fundamentals among Asian markets than to mounting geopolitical risks in the Korea peninsula, as per the sources of Societe Generale. The investment thesis on Asia equities rests on earnings growth recovery, moderate equity valuation and plentiful liquidity. We maintain the positive view. Japan and Korea are among the equity markets we like. The North Korea risk is however not disappearing. The next joint US-South Korea military drills, scheduled from 21-31 August, could trigger further tension. An escalation in North Korea tensions would mark a pause in the Asia equity outperformance, with Korea and Japan equities being the most vulnerable.

South East Asia (NEA) to outperform North East Asia (NEA)

NEA (Korea, Taiwan, Japan) - The wider role of Korea in the global supply chain. A disruption would then negatively impact other countries including Taiwan (where hardware technology represents 62% of the equity market) and Japan.

The case for ASEAN markets. With the exception of Singapore, large ASEAN equities should be less sensitive to rising tensions on the Korean peninsula. The growth is more domestically driven (Philippines, Indonesia), the beta to global equity is lower (Malaysia), and even Thailand is increasingly becoming a domestic story with earnings recovering in the non-commodity space.

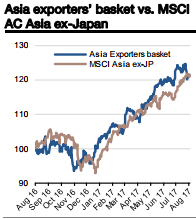

Asian exporters to underperform:

Asian exporters are more exposed to rising tensions.

The chart on the left tracks the performance of a basket of Asia exporters. The basket consists of stocks of companies deriving at least 60% of their revenues from foreign markets. Our eligible universe only includes large and liquid stocks from the automobile, capital goods, consumer durables, materials, transportation and technology hardware sectors with a market cap greater than USD 5bn.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?