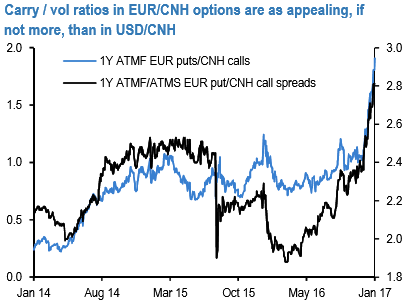

The carry trade looks far more lucrative in a non-dollar CNH cross such as EURCNH. The carry/vol setup is comparable to USDCNH (refer above chart), with the added attraction that the cross is that it is better insulated from dollar gyrations and therefore more liable to deliver positive carry returns.

Recall too that EUR has a substantial 16% weight even in the expanded CFETS basket, so EURCNH is a special cross that can be considered to be the most parsimonious reduced form representation of the basket itself and subject to tight PBoC management; also importantly, one where option markets are somewhat liquid and leveraged carry expressions realistic.

Since the CNY basket has traded largely sideways even through the turbulence unleashed by the US election outcome, it and its proxies such as EURCNH strike us as friendlier animals to bet stability on.

We like to initiate 3M ATMF vs. ATMS EUR put/CNH call vanilla spreads this week to earn carry in the cross, more esoteric expressions can take the form of ITMS EUR put/CNH call at-expiry digitals.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data