Fundamentals (growth and interest differentials), and sentiment (expectations of CNY depreciation and policy uncertainties) are key forces driving capital flows.

But the roles played by these forces and their impact, have varied, with the flow more sensitive to CNY/USD outlook in recent years.

Capital controls have been effective, as historical relationships consistently over-predict outflows.

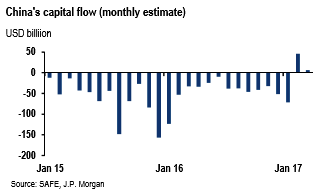

Historical patterns suggest 2017 outflows around US$400 billion, but there could be large deviations based on policy response, in particular, the intensification or easing of capital controls.

China’s FX reserves rose for the second month in a row in March. With a small current account deficit in March, this rise hints at renewed modest capital inflows, after a prolonged period of outflows starting in 2015 (refer above diagram).

Solid domestic growth and stricter capital controls seem to have eased outflow pressure.

An ongoing tug-of-war between fundamental forces and sentiment has shaped China’s cross-border financial flows; in this research note, we develop a framework to quantify the relationship.

We focus on non-FDI capital flows, as FDI flows tend to be long-term investments and relatively stable at high frequencies. But we do discuss FDI briefly at the end of the note.

The reflation theme has seen a significant improvement in China nominal growth, which in turn has led to higher domestic interest rates. This has been one factor that has helped stem capital outflow pressures.

However, the reflation theme has also reduced the current account surplus, which now sits at around 1.5% of GDP. Such an outcome feeds into our fair value framework and will tend to bias USDCNY higher. Of course, the latest set of trade data shows some reversal of the recent trends with import growth slowing and the trade surplus widening.

Overall, as China growth momentum gradually eases and we see further Fed hikes, USDCNY should gravitate higher. However, the pace of CNY depreciation should be lower compared with previous years, as the factors outlined above should present less of a headwind to the currency. In turn, this leaves comfortable with our 7.05/7.10 forecast for USDCNY over the coming 12 months. Hence, the concerns around renewed China weakness may stoke fears of fresh capital outflow pressures.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand