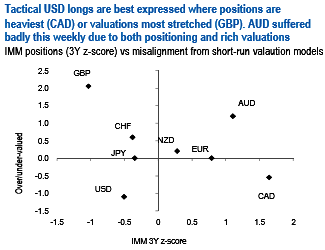

Cable is the most over-valued G10 currency versus the dollar (refer above chart). Indeed, cable is more expensive versus 2Y rate spreads than at any point in the last five years. Fair-value currently languishes at 1.15, more than two sigma below the spot rate (refer above chart).

GBP is consequently one of the most attractive currencies to sell for an extension of the dollar’s interest rate rally. There is also a strong domestic case to re-sell GBP insofar as:

1) The economy is now more clearly slowing in response to an inflation drag on consumption and underlying business caution due to Brexit. Growth in Q1’17 is expected to be only half the 2.9% recorded in Q4’16. High hopes for BoE rate hikes this year have been crushed.

2) The government is on course to trigger Article 50 by the middle of the month despite a setback in the House of Lords for its enabling legislation Q1 over Article50. Investor confidence is vulnerable as it should become apparent relatively early into the formal negotiations that the UK is on course for a harder Brexit with all of the economic disruption that leaving the single market is likely to entail.

3) The Scottish National Party is expected to argue at its conference on March 18-19 that a second referendum on independence should be held. The UK government is expected to resist such a call for now, but investors will be reminded that the break-up of the UK is a high-probability consequence of the UK’s decision to leave the EU.

The main risk to a cable short comes from a downgrade of European political risk and a consequent squeeze higher in EURUSD, albeit EURGBP would take up quite a bit of the slack of a resurgent EUR.

Sell GBPUSD at 1.2150, stop at 1.2530.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios