Please be noted that EURJPY has witnessed the sizeable price slumps and rallies upon below mentioned candlesticks patterns.

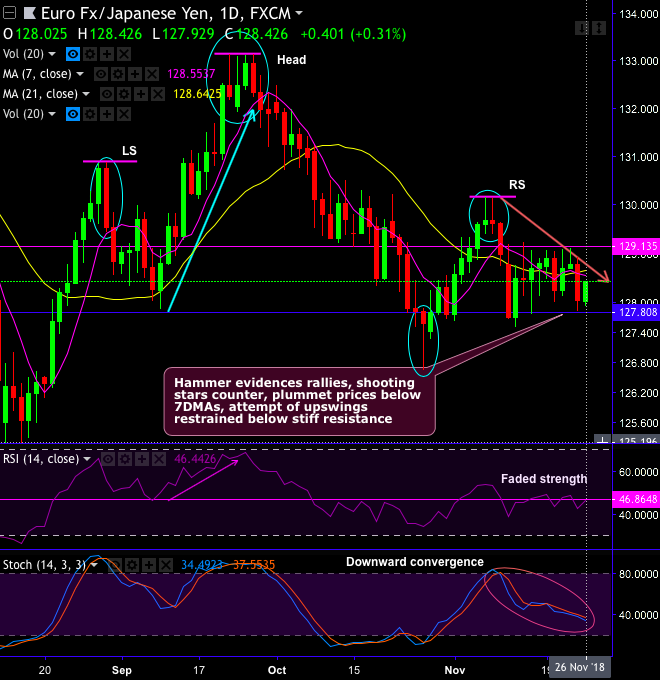

Technical chart and candlestick patterns formed – The minor trend has formed head and shoulder pattern with head at 133.131, left shoulder at 130.866 and right shoulder at 130.148 levels. If bears prolong downswings, then it is most likely to extend right shoulder.

Hammer patterns have occurred at 127.574 and 128.694 levels, on the flip side, the stern shooting star patterns have occurred at 129.690, 129.607 and 132.336 levels (on both daily and monthly terms). While the stiff resistance is observed at 129.135 levels.

Momentum study:Both leading (RSI & stochastic curves) oscillators show downward convergence that indicate intensified bearish momentum and overbought pressures on both monthly and daily terms.

The current major trend is stuck in range, while bearish swings are backed by the momentum oscillators.

MACD signals downswings continuation in the major trend and mild rallies on daily terms.

The major trend has formed streaks of bearish patterns, such as, shooting star, hanging man & bearish engulfing evidence price drops below EMAs, ever since then, bears managed to retrace more than 38.2% Fibonacci levels. But for now, stuck in between 23.6% and 38.2% Fibonacci levels.

Overall, the trend continues to be weaker on the major terms and drifts upward for today.

Trade tips: On trading perspective, at spot reference: 128.452 levels, it is advisable to snap any abrupt rallies and bid tunnel put option spreads, use upper strikes at 128.6437 and lower strikes at 127.929 levels, the strategy is likely to fetch leveraged yields as long as the underlying spot FX keeps dipping further until expiration.

Alternatively, we advocate shorts in futures contracts of mid-month tenors with a view to arresting potential dips.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -54 levels (which is bearish), while hourly JPY spot index was at 12 (mildly bullish) while articulating at 05:09 GMT. For more details on the index, please refer below weblink: