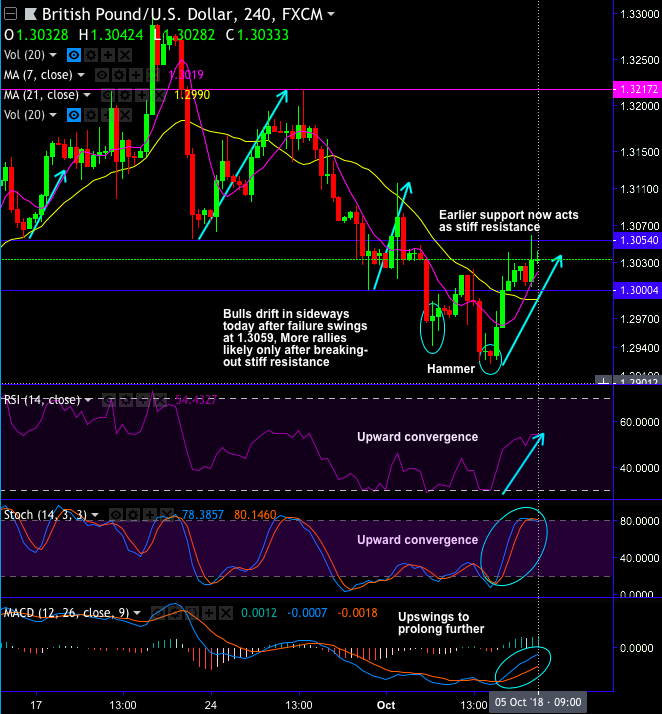

GBPUSD (cable) price sentiments are attempting to build on the rebound from the lows of 1.2925-1.30 region, coupled with the bullish momentum. Nevertheless, 1.3055-1.3100 is still perceived as the major barrier ahead of the 1.32-1.33 recent highs. As you could closely watch, the earlier support now acts as the stiff resistance.

From last three days, bulls have been attempting to hold onto the strong support at 1.30 levels, but for today, drift in sideways today after failure swings at 1.3059, More rallies likely only after breaking-out stiff resistance.

While the USD is on the front foot, which may limit the upside, unless we get significant Brexit deal news, in which case we could allow for a move towards 1.34-1.35 zone, but crosses are likely to reflect this strength more so.

Down through 1.2925/05 would sour the outlook and see a slide towards 1.2800 and potentially 1.2700 again.

On a broader perspective, formation of hammer pattern at 1.2950 levels evidences rallies last month but restrained well below 7EMAs.

We reckon that the bear cycle that began back in 2007 at 2.1160 completed at 1.1490. On a multi-year basis, this suggests mean reversion back to 1.50-1.60 but certainly not in the near terms.

Trade tips: Well, on trading perspective, at spot reference: 1.3230 levels, contemplating above explained technical rationale, it is advisable to trade barrier option strategy using boundary strikes, upper strikes at 1.3054 and lower strikes at 1.3019 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX remains between these strikes on expiry duration.

Alternatively, on hedging grounds, shorting futures contracts of mid-month tenors were advocated, now we wish to uphold the same position as the underlying spot FX likely to slide southwards 1.2785 levels in the near terms.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 71 levels (which is bullish), while hourly USD spot index was at 50 (bullish) while articulating (at 09:55 GMT).

For more details on the index, please refer below weblink: