NZD outperformed against JPY, despite a modest upside surprise from the GDT dairy auction, spiking higher from 76.270 to 81.115.

The RBNZ has signaled the next cycle – a tightening one – will not start until late 2019. That will anchor the short end, although markets will not abandon their expectations for tightening as early as mid-2018 which mean occasional spikes in the 2yr will be likely.

Positive outlook for NZD: Inflation has peaked higher recently, and the RBNZ is on track to tighten monetary policy in early 2018, which would solidify the Kiwi dollar’s position as the highest carry G10 currency. The risk of another flare-up of China growth fears could hold back the NZD in H2’17, but the currency should ultimately benefit from expectations of policy tightening.

OTC Outlook

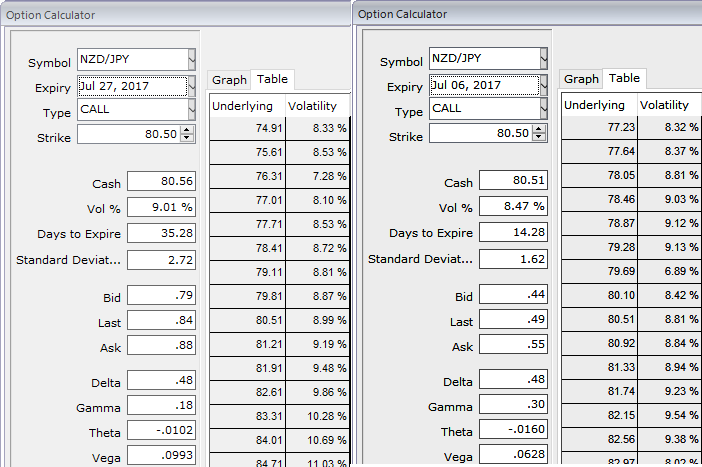

ATM IVs of NZDJPY is trading between 9% and 8.5% for 1m and 2w tenors respectively.

Please also be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favour. If IV increases and you are holding an option, this is good. When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Option Strategy:

Thus, conservative hedgers can prefer the below strategy:

Debit Put Spread = Go long 1M ATM -0.49 delta Put + Short 2w (1%) ITM Put with lower Strike Price with net delta should be at -0.40.

For a net debit bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand